Chase's BNPL Policy Shift: What It Means For You

In a significant move that has sent ripples through the personal finance landscape, JPMorgan Chase Bank has recently revealed that it is reversing course on allowing its customers a convenient privilege that many had come to rely on. This decision, primarily targeting the popular "Buy Now, Pay Later" (BNPL) services, marks a notable shift in how one of the nation's largest financial institutions views and manages consumer credit. For millions of Chase cardholders, this change could necessitate a re-evaluation of their spending habits and financial strategies.

The banking giant's announcement signals a broader trend in the financial sector, where traditional banks are increasingly grappling with the rise of alternative payment methods. While the immediate impact will be felt by Chase customers, the implications of such a policy change could extend far beyond, influencing how other major banks approach similar financial products and services. Understanding the nuances of this decision is crucial for anyone looking to maintain financial stability and leverage their credit effectively in an evolving economic environment.

Table of Contents

- The Unveiling of Chase's Policy Reversal

- Understanding the "Privilege" Being Revoked

- Chase's Stance: BNPL as a Form of Credit

- Potential Havoc on Personal Finances

- The Broader Implications for the Banking Sector

- Customer Feedback and Concerns

- What Customers Can Do Now

- Looking Ahead: The Future of Consumer Credit

The Unveiling of Chase's Policy Reversal

JPMorgan Chase Bank (JPM) recently revealed that it is reversing course on allowing its customers a convenient privilege that holds the risk of wreaking havoc on their finances. This significant policy shift centers on the bank's stance on Buy Now, Pay Later (BNPL) loans. The bank has recently been warning customers that it is banning its credit cards from being used to pay for BNPL installments. This move comes after a period where BNPL services have exploded in popularity, offering consumers a flexible way to spread out payments for purchases, often without interest if paid on time. For many, using their Chase credit cards to fund these BNPL arrangements was a strategic financial maneuver, allowing them to earn rewards points or manage cash flow more effectively. The revocation of this popular privilege by Chase is a direct challenge to this growing trend and forces a re-evaluation of consumer payment strategies.

The announcement, as reported by outlets like The New York Times, clarifies that Chase views BNPL loans as "a form of credit" and, consequently, does not permit customers to pay for credit products with Chase credit cards. This interpretation is key to understanding the bank's rationale. From Chase's perspective, allowing a credit card to pay off another form of credit (a BNPL loan) essentially amounts to using one line of credit to pay another, which can complicate risk assessment and potentially lead to a stacking of debt. This policy is a clear indicator that Chase is tightening its grip on how its credit products interact with emerging financial technologies, aiming to mitigate risks they perceive in the BNPL ecosystem.

Understanding the "Privilege" Being Revoked

To fully grasp the impact of Chase's decision, it's essential to understand what exactly the "privilege" entails and why it was so valued by customers. The privilege in question is the ability to use a Chase credit card to make payments on Buy Now, Pay Later (BNPL) loans. For a considerable period, many consumers found this a highly advantageous financial maneuver, allowing them to bridge gaps in their immediate liquidity, manage larger purchases without immediate full payment, and even leverage credit card rewards programs. The convenience and flexibility offered by this approach made it a popular choice, integrating BNPL into their broader financial management strategy.

The Rise of Buy Now, Pay Later (BNPL)

The Buy Now, Pay Later model has surged in popularity over recent years, becoming a ubiquitous option at online checkouts and even in brick-and-mortar stores. BNPL services, offered by companies like Affirm, Afterpay, Klarna, and PayPal, allow consumers to split the cost of a purchase into several interest-free installments, typically over a few weeks or months. This payment method gained significant traction, especially among younger demographics, for its perceived simplicity and accessibility compared to traditional credit cards or personal loans. It provided an alternative for those who might not qualify for conventional credit or who preferred to avoid the revolving interest of credit cards for specific purchases. Its growth was accelerated by the e-commerce boom, making it a seamless part of the online shopping experience.

Why Customers Loved This Option

Customers embraced the ability to pay BNPL installments with their Chase credit cards for several compelling reasons. Firstly, it offered unparalleled flexibility. For larger purchases, spreading payments across multiple billing cycles without incurring immediate credit card interest was a significant benefit. Secondly, and perhaps most importantly for many, it allowed them to "double-dip" on rewards. By paying BNPL installments with a rewards-earning Chase credit card (like a Chase Southwest Rapid Rewards credit card or other Chase credit card offers for personal use and business), customers could earn valuable points, miles, or cash back on purchases they were already making. This effectively turned a zero-interest loan into a rewards-generating opportunity. Furthermore, it aided in cash flow management, allowing individuals to keep more liquid funds in their Chase Total Checking® or Chase Savings℠ accounts while still making necessary purchases. This strategic use of credit was seen as a smart way to maximize financial benefits, and its revocation means a loss of this strategic advantage.

Chase's Stance: BNPL as a Form of Credit

JPMorgan Chase Bank's decision to revoke this popular privilege stems from its fundamental classification of Buy Now, Pay Later (BNPL) loans. As the bank explicitly stated, BNPL loans are considered "a form of credit." This classification is crucial because, under Chase's long-standing policies, it does not allow customers to use one form of credit (a Chase credit card) to pay off another form of credit (a BNPL loan). This policy is not entirely new; it aligns with the bank's general stance against using credit cards for cash advances or balance transfers to other credit products without specific authorization or a dedicated offer. The application of this rule to BNPL is, however, a relatively recent interpretation and enforcement.

From a banking perspective, allowing credit cards to pay BNPL installments introduces layers of complexity and potential risk. Firstly, it can obscure the true level of a customer's indebtedness. A customer might have a BNPL loan, which is then paid off by a credit card, making it harder for the bank to get a holistic view of their financial obligations. Secondly, it could inadvertently encourage a cycle of debt. If a customer is using a credit card to pay a BNPL installment, it suggests they might not have the immediate funds, potentially leading to carrying a balance on their credit card and incurring interest there, effectively transforming an interest-free BNPL loan into an interest-bearing credit card debt. This practice could hold the risk of wreaking havoc on their finances, a concern Chase is clearly trying to mitigate.

Moreover, the bank's decision could be a proactive measure to manage regulatory scrutiny. As BNPL services grow, regulators are increasingly examining their impact on consumer debt and financial stability. By clearly defining BNPL as credit and restricting payment methods, Chase is arguably taking a conservative approach to protect both its customers and its own risk profile. This strategic move by Chase is revoking a popular privilege, but from the bank's viewpoint, it's a necessary step to maintain financial prudence and transparency within its vast network of accounts and transactions. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place, and this policy helps streamline that oversight.

Potential Havoc on Personal Finances

The reversal of this policy by JPMorgan Chase Bank could indeed hold the risk of wreaking havoc on the finances of many customers who had integrated BNPL payments into their credit card strategy. While the bank's intention may be to prevent the stacking of debt, the immediate consequence for consumers is the loss of a flexible financial tool that many found beneficial for managing their cash flow and maximizing rewards. This shift necessitates a careful review of personal financial strategies and a proactive approach to adapting to the new rules.

Impact on Credit Card Rewards and Debt Management

One of the most immediate and tangible impacts for customers is the cessation of earning credit card rewards on BNPL payments. For those who strategically used their Chase Southwest Rapid Rewards credit card or other rewards cards to pay BNPL installments, this means losing out on points, miles, or cash back that previously accumulated with each payment. This can significantly diminish the overall value proposition of using BNPL services for rewards-focused consumers. Furthermore, for individuals who relied on this method to manage their debt by essentially "floating" BNPL payments on their credit card until their next pay cycle, the policy change removes a crucial safety net. They will now need to ensure they have sufficient funds directly in their checking or savings accounts (like the popular Chase Savings℠ account) to cover BNPL installments, or risk incurring late fees from the BNPL provider or, worse, defaulting on payments.

The change also impacts how customers manage their overall credit utilization and debt. Previously, if a BNPL payment was made with a Chase credit card, it would appear as a regular transaction on the credit card statement. Now, customers must manage BNPL payments as a separate financial obligation, directly from their bank accounts. This requires greater diligence and careful budgeting to avoid overextending their finances. For questions or concerns, customers are encouraged to contact Chase customer service or let us know about Chase complaints and feedback, as understanding these changes is vital.

Navigating the New Financial Landscape

Navigating this new financial landscape requires a proactive approach. Customers who frequently use BNPL services and have Chase credit cards must now re-evaluate their payment methods. This might mean setting up direct debits from their Chase Total Checking® account or another checking account for BNPL installments. It also highlights the importance of maintaining a healthy emergency fund to cover unexpected expenses or payment obligations. The bank's move serves as a stark reminder that while conveniences are often embraced, they can also be revoked, requiring consumers to be agile and informed about their financial choices. To learn more, visiting the banking education section on Chase's website can provide valuable insights into managing accounts and understanding policies.

The Broader Implications for the Banking Sector

JPMorgan Chase Bank's decision to revoke this popular privilege for its customers, specifically concerning BNPL payments, is not an isolated incident but rather a significant indicator of broader trends and concerns within the traditional banking sector. This move by one of the largest banks in the world could set a precedent, influencing how other major financial institutions view and interact with the rapidly evolving fintech landscape, particularly in the realm of consumer credit.

Firstly, it highlights the ongoing tension between traditional banking models and innovative fintech solutions. BNPL services emerged as a direct competitor to credit cards, offering an alternative that often bypasses the interest charges and complex terms associated with conventional credit. Banks like Chase are now asserting their control and defining the boundaries of how their established credit products can be used in conjunction with these newer services. This is a battle for market share and, more importantly, for risk management and oversight of consumer debt.

Secondly, the policy change underscores the increasing focus on regulatory compliance and risk mitigation in the financial industry. As BNPL services have grown, so too has scrutiny from financial regulators regarding consumer protection, transparency, and the potential for accumulating unmanageable debt. By classifying BNPL as a form of credit and restricting payments, Chase is taking a proactive stance to align with potential future regulations and to mitigate its own exposure to risk from potentially over-leveraged customers. This is particularly relevant given the YMYL (Your Money or Your Life) nature of financial services, where banks have a responsibility to protect customer finances.

Lastly, this move might signal a shift towards banks developing their own BNPL-like products or integrating them more formally into their existing offerings, rather than allowing external BNPL providers to operate unchecked within their credit ecosystems. Some banks have already started exploring their own installment loan options. By restricting the use of their credit cards for third-party BNPL payments, Chase might be clearing the path for its own future credit innovations or simply enforcing a clearer delineation between its proprietary credit products and those offered by fintech companies. This strategic decision by Chase is revoking a popular privilege, but it's also a statement about the bank's vision for the future of consumer credit and its role within it.

Customer Feedback and Concerns

The announcement that Chase is revoking a popular privilege to its customers, specifically the ability to pay BNPL installments with Chase credit cards, has naturally elicited a range of reactions from its vast customer base. Online forums, social media platforms, and customer service lines have likely seen an uptick in inquiries and expressions of concern, reflecting the immediate impact this policy change has on personal financial planning and convenience.

Many customers who had strategically integrated BNPL into their spending habits are expressing disappointment. For them, the ability to earn credit card rewards on these payments was a significant draw, effectively making their purchases more economical. The loss of this benefit is seen as a direct reduction in the value they derive from their Chase credit cards. Others are concerned about the logistical challenges of adjusting their payment routines. Having to remember to pay BNPL installments directly from a checking account, rather than consolidating them onto a credit card statement, adds an extra layer of financial management that some may find cumbersome.

There's also a segment of customers who might not fully understand the bank's rationale, perceiving the move as an arbitrary restriction rather than a risk management strategy. This lack of clarity can lead to frustration and a feeling that a valuable tool has been unfairly taken away. Some may even view it as a step backward in financial flexibility, especially in an era where consumers are increasingly seeking personalized and convenient payment solutions. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. This direct line of communication is crucial for addressing customer apprehension and providing clarity on the policy's implications.

Conversely, some financially savvy customers might understand Chase's perspective, acknowledging the potential for debt stacking that the previous arrangement allowed. However, even these individuals might lament the loss of the rewards-earning opportunity. The overall sentiment suggests a need for clear communication from Chase regarding the reasoning behind the policy and practical advice on how customers can best adapt to ensure their financial well-being.

What Customers Can Do Now

With Chase revoking a popular privilege concerning BNPL payments, customers need to take proactive steps to adapt their financial strategies. This isn't just about understanding the new rules; it's about implementing practical changes to ensure continued financial health and avoid unexpected issues. Here are several actionable steps customers can take:

- Update Payment Methods for BNPL: The most immediate action is to change how you pay your existing and future BNPL installments. Instead of using a Chase credit card, set up direct payments from your checking account, such as your Chase Total Checking® account. Ensure you have sufficient funds available on the due dates to avoid late fees from BNPL providers.

- Review Your Budget: Re-evaluate your monthly budget to account for BNPL payments coming directly from your bank account. This might require adjusting other spending categories or reallocating funds to ensure adequate liquidity for these obligations.

- Explore Alternative Rewards Strategies: If earning rewards was a primary reason for using your Chase credit card for BNPL, consider other ways to maximize your rewards. Explore all of Chase's credit card offers for personal use and business to find the best rewards cards, travel cards, and more for your everyday spending. You might find that shifting certain spending categories to specific cards can still help you earn significant rewards.

- Understand Your Credit Card Terms: Regularly review the terms and conditions of your Chase credit cards. Familiarize yourself with policies regarding cash advances, balance transfers, and what constitutes a "credit product" payment to avoid future surprises.

- Build an Emergency Fund: This policy change underscores the importance of having a robust emergency fund. A well-funded savings account, like the Chase Savings℠ account, can provide a buffer for unexpected expenses and ensure you can cover all your payment obligations without resorting to high-interest credit.

- Contact Chase Customer Service: If you have specific questions about your accounts or how this policy impacts your unique financial situation, don't hesitate to contact Chase customer service. They can provide personalized guidance and clarify any ambiguities. You can also view the Chase Community Reinvestment Act public file for the bank’s broader commitments.

- Consider Other Payment Options: For future purchases where you might have considered BNPL, evaluate other payment options. This could include using a debit card, saving up for the purchase, or utilizing other credit products that align with your financial goals.

By taking these steps, customers can smoothly transition to the new policy and maintain effective control over their finances, even as Chase is revoking a popular privilege.

Looking Ahead: The Future of Consumer Credit

The decision by JPMorgan Chase Bank to revoke a popular privilege related to Buy Now, Pay Later (BNPL) payments is more than just a policy change; it's a significant marker in the evolving landscape of consumer credit. This move, particularly from a financial behemoth like Chase, offers a glimpse into what the future of lending and payment processing might entail for both traditional banks and innovative fintech companies.

One key implication is the potential for increased consolidation or clearer demarcation in the credit market. As banks assert their traditional credit rules over newer payment methods, we might see a push towards either greater integration of BNPL services directly into bank offerings or a more distinct separation where BNPL remains a standalone product, requiring direct payment from checking accounts. This could lead to banks developing their own proprietary installment loan products, similar to BNPL, that are fully integrated with their existing credit card ecosystems and rewards programs, thus offering consumers a "bank-backed" BNPL option.

Furthermore, this policy shift could accelerate regulatory efforts to standardize the BNPL industry. If major banks are treating BNPL as a form of credit, it strengthens the argument for consistent consumer protection laws, disclosure requirements, and credit reporting practices across all BNPL providers. This would bring more transparency and potentially greater safety for consumers, but it could also stifle some of the innovation and flexibility that initially propelled BNPL's growth.

For consumers, the future likely holds a more complex, yet potentially more transparent, credit environment. They will need to be more diligent in understanding the terms and conditions of various payment methods and how they interact with their primary banking relationships. The days of seamlessly "double-dipping" on rewards or using one form of credit to easily manage another might become less common. Instead, financial literacy and strategic planning will become even more critical. Consumers will need to actively manage their Chase accounts, monitor activity, and pay bills from one central place, ensuring they understand all their financial obligations.

Ultimately, while Chase is revoking a popular privilege, this move reflects a broader industry recalibration. It's a signal that traditional financial institutions are adapting to the fintech revolution, seeking to manage risk and maintain control over the credit landscape. The outcome will shape how consumers access and manage credit for years to come, emphasizing responsible borrowing and a clearer understanding of financial products.

Conclusion

The recent decision by JPMorgan Chase Bank to reverse its policy on allowing customers to pay Buy Now, Pay Later (BNPL) installments with Chase credit cards marks a pivotal moment in consumer finance. This revocation of a popular privilege, while perhaps inconvenient for many, underscores Chase's commitment to managing credit risk and maintaining the integrity of its financial products. By classifying BNPL as a form of credit, the bank aims to prevent potential financial pitfalls for its customers, even if it means altering established spending habits and rewards strategies.

This move highlights the evolving relationship between traditional banking and the burgeoning fintech sector, signaling a potential trend where major financial institutions exert greater control over how their credit products interact with alternative payment methods. For customers, the key takeaway is the imperative for adaptability and informed financial management. Reviewing payment methods, adjusting budgets, and exploring alternative reward strategies are essential steps to navigate this new landscape effectively. While the immediate impact may be felt through changes in convenience and rewards, this policy shift ultimately serves as a reminder of the dynamic nature of personal finance and the importance of staying vigilant.

We encourage you to share your thoughts on this significant policy change. How does Chase's decision impact your financial planning? What strategies are you adopting to adapt? Leave a comment below and join the conversation. For more insights into managing your finances and staying updated on banking trends, explore other articles on our site.

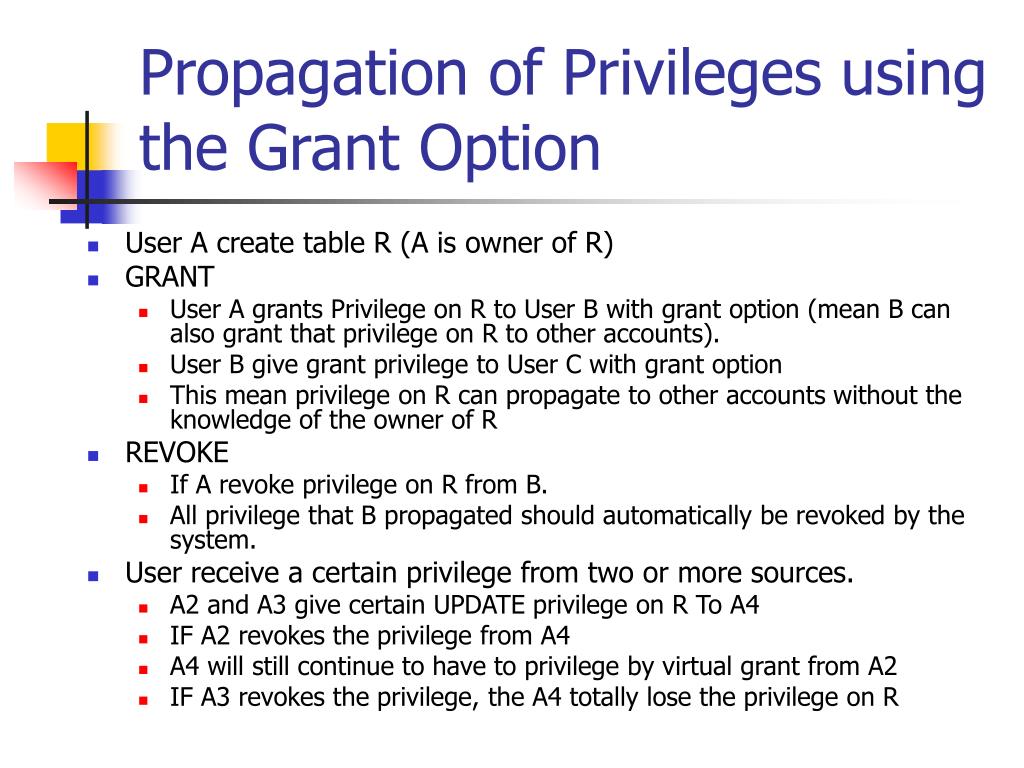

PPT - Security and Integrity PowerPoint Presentation, free download

![Chase Sapphire Reserve: Car Rental Insurance Benefits [2023]](https://upgradedpoints.com/wp-content/uploads/2019/02/Car-Rental-privileges-.png)

Chase Sapphire Reserve: Car Rental Insurance Benefits [2023]

![Chase Sapphire Preferred vs. Amex Platinum [2025]](https://upgradedpoints.com/wp-content/uploads/2022/09/Chase-Sapphire-Preferred-vs-Amex-Platinum-Upgraded-Points-LLC.jpg)

Chase Sapphire Preferred vs. Amex Platinum [2025]