GMF DAS: Navigating Digital Pathways In Finance And Insurance

## Table of Contents * [The Dual Pillars of GMF: Insurance and Financial Services](#the-dual-pillars-of-gmf-insurance-and-financial-services) * [GMF Insurance: A Human Touch in the Digital Age](#gmf-insurance-a-human-touch-in-the-digital-age) * [Personalized Protection: Auto, Moto, and Health](#personalized-protection-auto-moto-and-health) * [Your GMF Space: Digital Control Over Your Policies](#your-gmf-space-digital-control-over-your-policies) * [GM Financial: Driving Automotive Lending with Digital Prowess](#gm-financial-driving-automotive-lending-with-digital-prowess) * [DealerSource: Empowering Automotive Businesses](#dealersource-empowering-automotive-businesses) * [GMF Connect: Seamless Customer Engagement](#gmf-connect-seamless-customer-engagement) * [Understanding DAS: The Backbone of Lender-Dealer Collaboration](#understanding-das-the-backbone-of-lender-dealer-collaboration) * [Security and Accessibility in GMF DAS Platforms](#security-and-accessibility-in-gmf-das-platforms) * [The Future of GMF DAS: Innovation and User-Centric Design](#the-future-of-gmf-das-innovation-and-user-centric-design) * [Choosing GMF: A Commitment to Service and Digital Excellence](#choosing-gmf-a-commitment-to-service-and-digital-excellence)

## The Dual Pillars of GMF: Insurance and Financial Services When one encounters the acronym "GMF," it often refers to two distinct yet equally significant entities operating in different but related sectors: GMF Assurances, a prominent French insurance provider, and GM Financial, the captive finance arm of General Motors. Both organizations, despite their differing primary services, share a common thread: a deep reliance on sophisticated digital access systems to manage operations, serve customers, and interact with partners. The concept of "GMF DAS" truly comes alive when we consider how these entities leverage technology to deliver on their promises, whether it’s protecting personal assets or facilitating vehicle financing. GMF Assurances has built a reputation as a trusted insurer, particularly noted as the "1er assureur des agents du service public" (first insurer for public service agents) in France. Their focus is on providing comprehensive protection for individuals and their families, covering everything from vehicles to health and life insurance. On the other hand, GM Financial operates on a global scale, specializing in automotive financing for consumers and dealers. Their expertise in commercial and wholesale lending, spanning over three decades, positions them as a critical player in the automotive industry. The convergence of digital solutions for both these GMF entities highlights a broader trend in the financial and insurance sectors: the indispensable role of robust, secure, and user-friendly digital platforms. ## GMF Insurance: A Human Touch in the Digital Age "Découvrez les assurances de GMF, un choix assurément humain pour protéger vos biens et vos proches," reads a core message from GMF Assurances. This commitment to a "human choice" extends even into their digital offerings, ensuring that while technology streamlines processes, it never detracts from personalized care. Their digital access systems are designed to put policyholders in control, offering convenience without sacrificing the essential human connection that defines their service. This is where the insurance aspect of GMF DAS truly shines. ### Personalized Protection: Auto, Moto, and Health GMF Assurances understands that every individual's needs are unique. This philosophy is embedded in their product offerings and, crucially, in how they allow customers to interact with these products online. For instance, with their "assurance auto" or "assurance moto," customers can "prendre la route en toute sérénité" (hit the road with peace of mind). The digital tools provided allow for quick and easy access to information regarding these policies. Beyond vehicles, GMF also addresses vital personal needs. "Besoin d’une assurance santé, d’une complémentaire ou mutuelle santé?" GMF offers a range of health contracts. Customers can "découvrez les contrats santé GMF et réalisez votre devis ou simulation en ligne." This ability to get a quote or simulation online for a tailored health insurance plan exemplifies the efficiency of their GMF DAS. Similarly, for auto insurance, the "assurance auto auto pass de GMF" allows users to "obtenir gratuitement un devis d'assurance auto sur mesure (personnalisé) qui protège votre véhicule, son conducteur et ses passagers." This personalization, accessible with "en quelques clics," underscores the user-centric design of their digital platforms. ### Your GMF Space: Digital Control Over Your Policies Central to the GMF insurance digital experience is "Votre espace GMF." This personalized online portal serves as the hub for policyholders to manage their accounts effortlessly. The creation of "votre espace client GMF vous permet de profiter de tous les services et avantages de la GMF en ligne en toute simplicité." This includes a suite of functionalities designed to simplify policy management: * **Consultation and Management of Contracts:** Users can "consulter et gérer vos contrats d’assurance vie… suivre l’évolution de vos contrats." This provides transparency and immediate access to crucial policy details. * **Access to Key Information:** "Retrouver les informations et documents clés de votre contrat" is made simple, ensuring that policyholders always have necessary paperwork at their fingertips, from policy terms to premium schedules. * **Claims Management:** In times of need, the GMF DAS simplifies the process. Users can "déclarez votre sinistre avec GMF et bénéficiez d'une assistance complète et rapide." The ability to "besoin de suivre votre sinistre" online provides reassurance and updates during a potentially stressful time. * **Communication:** For general inquiries, the platform guides users on "comment envoyer un message à GMF," facilitating direct and secure communication with customer service. * **Login and Security:** Accessing this vital space requires a secure login. Questions like "comment se connecter à l'espace client GMF" are addressed, emphasizing the importance of user authentication. The platform also handles security aspects like cookies, noting that "your browser is currently set to block cookies, you need to allow cookies to use this service," a standard practice for secure online environments. The GMF insurance digital ecosystem, including the "espace client GMF," represents a sophisticated GMF DAS that empowers policyholders with autonomy and accessibility, all while maintaining the human-centric approach that defines the brand. ## GM Financial: Driving Automotive Lending with Digital Prowess Shifting gears to the automotive finance sector, GM Financial stands as a powerhouse, providing crucial lending services that fuel the car industry. Their operations, particularly in wholesale lending, are inherently complex, involving intricate networks of dealers, manufacturers, and individual borrowers. This is precisely where robust digital infrastructure, forming a significant part of the GMF DAS, becomes indispensable. "Wholesale lending can be complicated, and that’s where we come in," states GM Financial, highlighting their role as a "trusted partner" with "over three decades of expertise in commercial lending." This expertise is increasingly delivered and managed through advanced digital platforms. ### DealerSource: Empowering Automotive Businesses For automotive dealers, GM Financial's "DealerSource" platform is a cornerstone of their operations. This critical component of the GMF DAS provides dealers with comprehensive access to a wide array of resources essential for managing their automotive businesses. "GMF DealerSource by GM Financial provides dealers access to a wide range of vehicle inventory and resources to support their automotive business needs." This centralized portal simplifies many aspects of dealership management, from inventory to financing. DealerSource offers: * **Inventory Management:** Dealers can efficiently track and manage their vehicle stock, optimizing their sales process. * **Auction Listings:** Access to auction information helps dealers acquire new inventory, crucial for maintaining a diverse selection for customers. * **Financing Tools:** The platform illustrates "exactly how we provide financing — from a borrower’s initial visit to the car dealership to GM." This transparency helps dealers guide customers through the financing process. * **Fleet Management Services:** Dealers can "access the GM Financial dealer portal for fleet management services," catering to commercial clients with specific needs. * **Support Resources:** "For additional support, click here" points to readily available help, ensuring dealers can quickly resolve issues. This integrated approach through DealerSource underscores GM Financial's commitment to supporting its dealer network with powerful, accessible digital tools, making it a vital part of the broader GMF DAS strategy for business-to-business interactions. ### GMF Connect: Seamless Customer Engagement Beyond dealer-facing solutions, GM Financial also provides direct digital access for its individual customers through platforms like "GMF Connect." This customer-centric portal is designed to offer convenience and control over their financing accounts. "Login to your GMF Connect customer account" is the gateway to managing their vehicle loans. Key features of GMF Connect, part of the extensive GMF DAS, include: * **Account Management:** Customers can view their loan details, payment history, and other essential account information. * **Payment Options:** The platform simplifies the payment process. Users can "select make payment on the myaccount dashboard," choose from "available payment options," and "complete the form and check the box to acknowledge payment terms." This streamlined process enhances customer satisfaction. * **Security Features:** Like the GMF insurance portal, GMF Connect prioritizes security. Messages like "your session is about to end, you've been inactive for a while, for your security, we'll automatically sign you out in..." are standard security measures to protect user data, highlighting the robust nature of the GMF DAS infrastructure. * **Password Reset:** For forgotten credentials, the system offers a secure way to regain access: "Enter the email address associated with your account, and we'll email you a link that will allow you to reset your password." The GMF Connect platform exemplifies GM Financial's dedication to providing a seamless, secure, and user-friendly digital experience for its customers, reinforcing the comprehensive nature of the GMF DAS in the financial services landscape. ## Understanding DAS: The Backbone of Lender-Dealer Collaboration The term "DAS" within the context of GMF's financial operations, particularly as referenced in the "Data Kalimat," strongly points to a Data Access System, likely related to "Datascan." This system is crucial for improving collaboration and efficiency in the complex relationship between lenders and their dealer networks. It represents a specialized component of the broader GMF DAS that focuses on data exchange and communication. "When information needs to be updated, lenders can use DAS to connect directly with their dealers," highlights the primary function of this system. In the fast-moving world of automotive finance, timely and accurate information is critical. Whether it's updating inventory, processing loan applications, or managing financial data, a direct and efficient channel for communication is invaluable. The DAS platform, as part of the GMF DAS, is "intelligently designed to improve collaboration," suggesting features that facilitate real-time data sharing and streamlined workflows. The mention of "Datascan community customer secure login page" and "Datascan’s WI solution" further clarifies that this DAS is a sophisticated technological solution for managing and accessing data within the lending ecosystem. It’s not just about transferring files; it's about creating a collaborative environment where lenders and dealers can work together more effectively. This could involve secure messaging, shared dashboards, or integrated reporting tools. The goal is to reduce friction, minimize errors, and accelerate processes, ultimately benefiting both the business partners and the end consumer who relies on quick and efficient financing solutions. This specific implementation of a DAS is a testament to how GMF (specifically GM Financial) invests in technology to optimize its core business processes. ## Security and Accessibility in GMF DAS Platforms In any digital ecosystem, especially one dealing with financial transactions and sensitive personal data, security and accessibility are paramount. The GMF DAS, across both its insurance and financial services arms, demonstrates a clear commitment to these principles. The "Data Kalimat" provides several cues regarding their approach to ensuring a secure and user-friendly environment. Security measures are evident in the login processes. Phrases like "we can't sign you in," followed by "your browser is currently set to block cookies, you need to allow cookies to use this service," emphasize the importance of standard web security protocols. Cookies, while sometimes misunderstood, are essential for maintaining secure sessions and personalizing user experiences in a safe manner. Furthermore, the implementation of "session timeout" features, such as "your session is about to end, you've been inactive for a while, for your security, we'll automatically sign you out in...", is a crucial security layer to prevent unauthorized access to accounts, especially on shared or public computers. This proactive approach to security is fundamental to maintaining trustworthiness, a core tenet of E-E-A-T. Accessibility is equally vital. The design of platforms like "Votre espace GMF," "DealerSource," and "GMF Connect" aims for simplicity and intuitive navigation. The ability to "login with your username and password" or to use a secure link for password resets (by entering "the email address associated with your account, and we'll email you a link") ensures that users can manage their accounts with minimal friction. The provision of customer support contact information, such as "Qui est le 0 970 809 809?" (likely a customer service number for GMF Assurances) and "dealer solutions support dealer support," indicates that while digital tools are prioritized, human assistance remains readily available. This blend of robust digital infrastructure and accessible support ensures that the GMF DAS serves all users effectively and securely. ## The Future of GMF DAS: Innovation and User-Centric Design The digital landscape is constantly evolving, and for entities like GMF, staying at the forefront of technological innovation is not merely an option but a necessity. The existing GMF DAS platforms, from the comprehensive "espace client GMF" to the specialized "DealerSource" and the collaborative "DAS" for lender-dealer interactions, already showcase a strong foundation. However, the future promises even more sophisticated and integrated solutions, driven by a relentless focus on user-centric design and the continuous pursuit of efficiency. One key area of future development for GMF DAS will likely involve enhanced personalization through advanced data analytics. Imagine insurance quotes that are even more precisely tailored to individual lifestyles, or financing options for dealers that dynamically adjust based on real-time market conditions. Artificial intelligence and machine learning could play a significant role in predicting customer needs, automating routine tasks, and providing proactive support. For instance, AI-powered chatbots could offer instant answers to common queries, freeing up human agents for more complex issues, further streamlining interactions for both GMF insurance policyholders and GM Financial customers. Furthermore, the integration of various GMF DAS components is expected to deepen. While currently distinct, the underlying technologies could converge to create a more unified experience across different GMF services, where applicable. This might involve a single sign-on experience for users who interact with multiple GMF entities, or a more seamless flow of information between internal departments to improve service delivery. The emphasis will remain on making digital interactions intuitive, secure, and genuinely helpful, ensuring that the GMF DAS continues to be a trusted and reliable partner in both personal and professional financial journeys. The goal is to anticipate user needs and deliver solutions that simplify complex processes, embodying the "human choice" in a technologically advanced world. ## Choosing GMF: A Commitment to Service and Digital Excellence In a world increasingly reliant on digital interactions, the choice of a financial or insurance partner often hinges on their ability to provide secure, efficient, and user-friendly online services. GMF, through its various entities and the robust GMF DAS (Digital Access System) it employs, stands out as a strong contender in both the insurance and automotive finance sectors. Their commitment to leveraging technology to enhance customer and partner experiences is evident in every facet of their digital offerings. From the personalized "assurance auto sur mesure" and comprehensive health insurance quotes available online through GMF Assurances, to the powerful "GMF DealerSource" empowering automotive businesses, and the convenient "GMF Connect" for customer loan management, the focus is consistently on accessibility and control. The underlying "DAS" system, facilitating crucial lender-dealer collaboration, further underscores their dedication to operational excellence and efficiency. The emphasis on security features like cookie management and session timeouts, coupled with clear support channels, reinforces their trustworthiness. Ultimately, choosing GMF means opting for a partner that understands the complexities of modern finance and insurance, and actively invests in cutting-edge digital solutions to simplify them. Whether you are seeking comprehensive protection for your family and assets, or require sophisticated financing tools for your automotive business, the GMF DAS provides the digital pathways to navigate these needs with confidence and ease. Their blend of human-centric service and technological prowess makes GMF a compelling choice for those who value both reliability and digital convenience. --- We hope this deep dive into the GMF DAS has provided valuable insights into how GMF leverages technology to serve its diverse clientele. What are your experiences with digital platforms in the finance or insurance industry? Share your thoughts in the comments below! If you found this article informative, please consider sharing it with your network or exploring other related articles on our site.

Gmf Logo Vector - (.Ai .PNG .SVG .EPS Free Download) VectorSeek

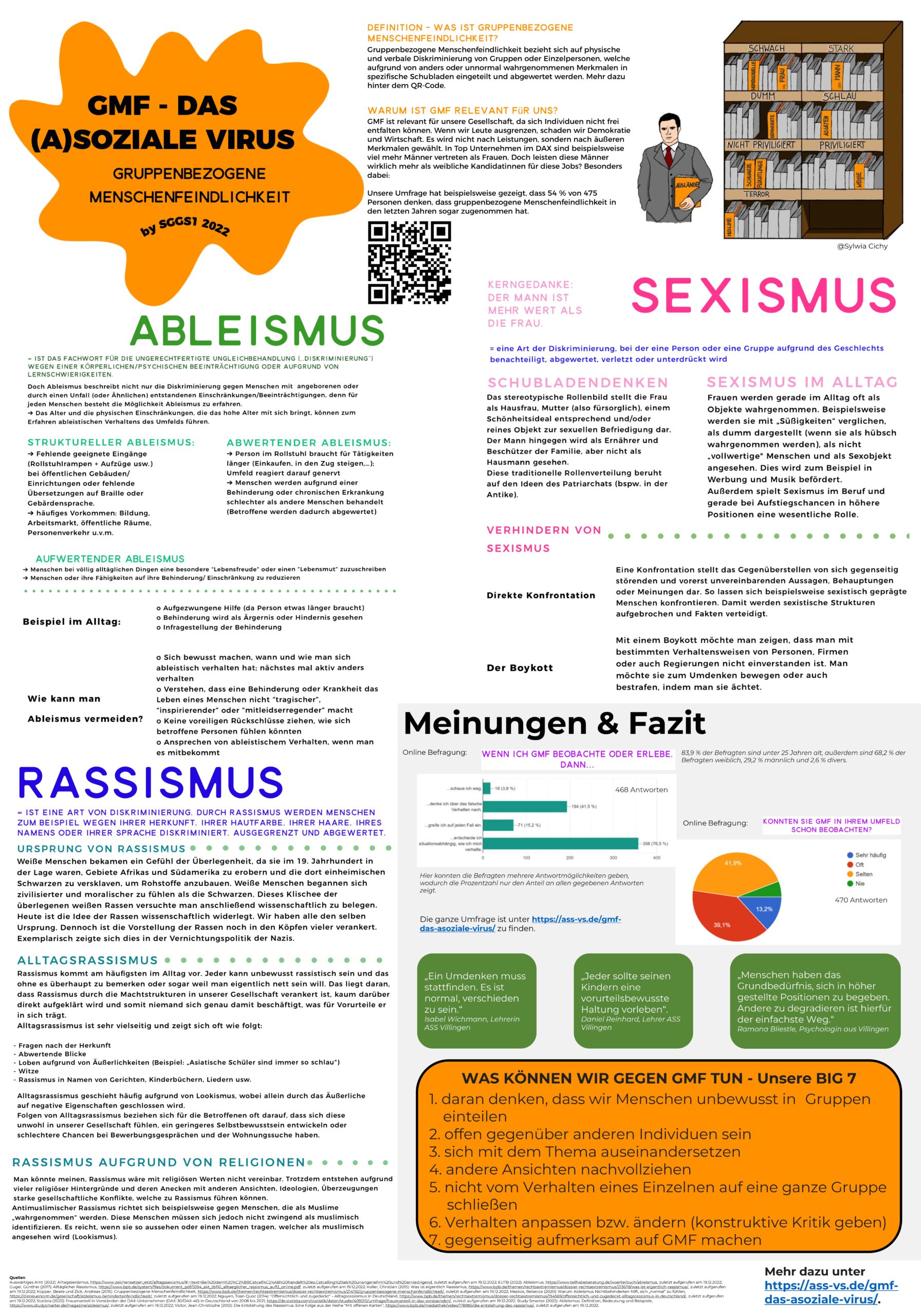

GMF - das (a)soziale Virus? | Albert-Schweitzer-Schule

Design Do Logotipo Da Letra Gmf Em Fundo Branco. Conceito De Logotipo