Harnessing Neg Power: EVs, Tax Credits, & Economic Freedom

In a world increasingly shaped by complex forces, understanding and leveraging what we might call "neg power" becomes crucial. This isn't about promoting negativity; rather, it's about recognizing the power to negate, to offset, or to transform adverse situations into advantageous ones. Just as ancient tales speak of mysterious substances with the power to alter minds and lure individuals, or "ill omens" that bring challenges, our modern lives present their own set of "negative forces"—from escalating fuel costs to environmental concerns.

However, just as there are forces that create challenges, there are also strategic tools and incentives designed to counteract them. This article delves into the practical application of "neg power" in the realm of personal finance and sustainable living, specifically focusing on how electric vehicles (EVs) and their associated tax credits offer a tangible way to negate financial burdens and environmental impact, paving the way for greater economic freedom and a healthier planet.

Table of Contents

- Understanding "Neg Power" in a Modern Context

- The Financial Burden: Why "Neg Power" is Needed

- Electric Vehicles: A Counter-Force to Negative Trends

- Unlocking the "Neg Power" of Tax Credits: New EVs

- Extending "Neg Power": Used EV Tax Credits

- Beyond the Purchase: Long-Term "Neg Power" Savings

- Navigating the Future: Maximizing Your "Neg Power"

- Conclusion

Understanding "Neg Power" in a Modern Context

The concept of "neg power" is multifaceted. On one hand, it can represent destructive or malevolent forces—the kind of power that corrupts, misleads, or brings about undesirable outcomes. In the realm of fiction, we see this vividly portrayed in narratives like the Chinese adventure-action, sci-fi film "The Seven Relics of Ill Omen" (Bảy di vật tà ám). This movie, directed by Thái Duy Huân and adapted from Vĩ Ngư's novel "Thất Căn Hung Giản," explores the re-emergence of "tâm giản" or seven mysterious relics that possess strange powers. The film delves into an ancient era where an unknown, mysterious substance appears in Phượng Tử Lĩnh, capable of parasitizing human bodies, altering minds, and luring people. This narrative serves as a compelling allegory for how unchecked, negative influences—whether mystical or societal—can lead to dangerous paths, highlighting the need for vigilance and counter-forces.

On the other hand, "neg power" can be understood as the strategic application of force or policy to *negate* or *offset* existing negative impacts. This is where its practical utility shines in our contemporary world. We face real-world "ill omens" such as climate change, volatile energy markets, and the ever-increasing cost of living. These are forces that exert a negative pull on our collective well-being and individual financial stability. The ability to apply a counter-force—a "neg power" that reduces or eliminates these negatives—is precisely what we need to build a more sustainable and prosperous future. This article focuses on this latter, empowering interpretation, demonstrating how government incentives and technological advancements are providing individuals with the tools to wield this beneficial "neg power."

The Financial Burden: Why "Neg Power" is Needed

For many households, transportation costs represent a significant and often unpredictable financial burden. The price of gasoline fluctuates wildly, influenced by global events, supply chain disruptions, and geopolitical tensions. Beyond the pump, the maintenance of internal combustion engine (ICE) vehicles often involves frequent oil changes, spark plug replacements, and complex engine repairs that can quickly add up. These recurring and often escalating expenses exert a constant "negative power" on household budgets, limiting disposable income and creating financial stress.

Furthermore, the environmental impact of traditional gasoline-powered vehicles is a growing concern. Emissions contribute to air pollution, climate change, and public health issues. While these are not direct financial costs in the same way as fuel, they represent a broader societal "negative power" that eventually translates into economic burdens through healthcare costs, disaster relief, and resource depletion. The need for a transformative "neg power" that addresses both personal finance and environmental sustainability has never been more urgent.

Electric Vehicles: A Counter-Force to Negative Trends

Electric vehicles (EVs) have emerged as a powerful counter-force to many of the negative trends associated with traditional transportation. At their core, EVs offer a cleaner, more efficient, and often more enjoyable driving experience. By running on electricity rather than gasoline, they significantly reduce tailpipe emissions, contributing to cleaner air and a healthier environment. This directly negates one of the primary environmental "negative powers" of the automotive sector.

From a financial perspective, EVs offer substantial long-term savings. While the upfront cost of an EV can sometimes be higher than a comparable ICE vehicle, the operational costs are typically much lower. Electricity is generally cheaper and more stable in price than gasoline, leading to significant savings on "fuel." Moreover, EVs have fewer moving parts, requiring less maintenance and fewer fluid changes, which translates to lower service costs over the vehicle's lifespan. This inherent efficiency and reduced dependency on fossil fuels make EVs a natural embodiment of "neg power," actively working to reduce financial outflows and environmental harm.

Unlocking the "Neg Power" of Tax Credits: New EVs

Recognizing the transformative potential of electric vehicles, governments worldwide have introduced incentives to accelerate their adoption. In the United States, the Clean Vehicle Credits are a prime example of how policy can amplify the "neg power" of EVs, making them more accessible and financially appealing to a broader range of consumers. These credits directly reduce the purchase cost, effectively negating a portion of the initial investment.

Eligibility for New Clean Vehicle Credits

To harness this significant "neg power," it's crucial to understand the eligibility requirements for new electric vehicles. The IRS provides detailed guidelines, and taxpayers claim the credit using Form 8936. Key factors determine whether your purchase qualifies for a tax credit:

- Vehicle Manufacturer & Assembly: The vehicle must meet specific North American final assembly requirements.

- Battery Component Sourcing: A certain percentage of the battery components must be manufactured or assembled in North America.

- Critical Mineral Sourcing: A percentage of the critical minerals used in the battery must be extracted or processed in the U.S. or a country with a free trade agreement, or be recycled in North America.

- Manufacturer's Suggested Retail Price (MSRP): There are price caps based on vehicle type ($80,000 for vans, SUVs, and pickup trucks; $55,000 for other vehicles).

- Buyer Income Limitations: The credit is subject to modified adjusted gross income (MAGI) limits ($300,000 for married filing jointly, $225,000 for head of household, $150,000 for all other filers).

- Purchase Date: For new electric vehicles purchased in 2022 and onwards, the tax credit is available for purchases through December 31, 2032, unless the law changes. This means there’s no immediate rush to purchase a vehicle, allowing for careful consideration.

It is highly recommended to visit fueleconomy.gov for a list of qualified vehicles and the latest information on eligibility criteria, as these can be updated.

How to Claim Your New EV Credit

Claiming the new clean vehicle credit is a straightforward process once you've confirmed eligibility.

- Confirm with the Seller: When you buy the vehicle, it's essential to confirm with the seller that the car you have selected is eligible for the credit. Dealers should be able to provide you with the necessary documentation and information.

- Determine Qualification: You need to determine whether your purchase of an electric vehicle (EV) or fuel cell vehicle (FCV) qualifies for a tax credit based on the criteria mentioned above.

- Choose When to Take the Credit: For new vehicles, you can often choose to transfer the credit to the dealer at the point of sale, effectively reducing the purchase price immediately. Alternatively, you can claim the credit when you file your federal income tax return for the tax year in which you took possession of the vehicle.

- Use Form 8936: Regardless of when you choose to take the credit, you will claim the credit using Form 8936, Clean Vehicle Credits.

This mechanism effectively leverages "neg power" by directly reducing the financial barrier to EV ownership, making sustainable transportation a more viable option for many.

Extending "Neg Power": Used EV Tax Credits

The "neg power" of tax incentives isn't limited to new vehicles. Recognizing that not everyone can afford a brand-new EV, the government has also extended credits to qualified used electric vehicles, further broadening access to sustainable transportation and its associated financial benefits. This is a crucial step in making the transition to electric mobility more equitable and widespread.

Eligibility for Used Clean Vehicle Credits

If you buy a qualified used electric vehicle, you may be eligible for a clean vehicle tax credit of up to $4,000. However, there are specific conditions that must be met:

- Purchase from a Dealer: The vehicle must be purchased from a dealer, not a private seller.

- Purchase Price Limit: The sale price must be $25,000 or less. This ensures the credit targets more affordable used EVs.

- Vehicle Age: The vehicle must be at least two model years older than the calendar year in which you buy it. For example, if you buy a used EV in 2024, it must be a 2022 model year or older.

- First Transfer: The sale must be the first qualified used clean vehicle sale to a buyer other than the original owner.

- Buyer Income Limitations: Similar to new EVs, there are MAGI limits ($150,000 for married filing jointly, $112,500 for head of household, $75,000 for all other filers).

These criteria ensure that the credit supports a robust used EV market while preventing abuse and focusing benefits on those who need them most.

Amending Returns for Past Purchases

For those who may have purchased an electric vehicle before 2022 but missed out on claiming a relevant credit, there's still a potential opportunity to leverage this "neg power." If you missed claiming a credit for an electric vehicle purchased before 2022, you may be able to claim it by filing an amended return for the tax year when you took possession of the vehicle. This requires reviewing past tax laws and ensuring your purchase met the criteria at that time. Consulting with a tax professional is advisable for this process to ensure compliance and maximize your potential refund.

Beyond the Purchase: Long-Term "Neg Power" Savings

The financial benefits of EVs extend far beyond the initial tax credit. The true "neg power" of electric vehicles manifests over their entire lifespan through significantly reduced operating costs.

- Reduced Fuel Costs: As mentioned, electricity is generally cheaper per mile than gasoline. The exact savings depend on local electricity rates and gasoline prices, but the difference is often substantial, leading to hundreds or even thousands of dollars in annual savings.

- Lower Maintenance: EVs have fewer moving parts than ICE vehicles. There's no engine oil to change, no spark plugs to replace, no timing belts, and no complex exhaust systems. This translates to less frequent and less expensive maintenance visits, further enhancing the "neg power" against traditional vehicle ownership costs.

- Home Charging Convenience: Installing an electric vehicle charger in your home can make charging an electric vehicle simpler, faster, and more cost-effective. Charging overnight at home, often during off-peak electricity hours, is incredibly convenient and can be significantly cheaper than relying solely on public charging stations. This home infrastructure also contributes to the long-term "neg power" by making EV ownership seamless and economically efficient.

- Alternative Fuel Vehicle Refueling Property Tax Credit: Beyond the vehicle purchase itself, there's also an alternative fuel vehicle refueling property tax credit available for installing qualified charging equipment at home or for business use. This further reduces the upfront cost of setting up your EV ecosystem, another layer of "neg power" at play.

These cumulative savings represent a powerful and sustained "neg power" against the rising cost of living, freeing up financial resources for other priorities and contributing to greater economic stability for EV owners.

Navigating the Future: Maximizing Your "Neg Power"

As the automotive industry continues its rapid evolution towards electrification, staying informed is key to maximizing the "neg power" available to consumers. Government incentives, vehicle eligibility criteria, and charging infrastructure are all subject to change.

- Stay Updated: Regularly check official government sources like the IRS website and fueleconomy.gov for the latest information on tax credits and qualified vehicles.

- Research Thoroughly: Before purchasing, research not only the vehicle's features but also its specific eligibility for credits and its long-term running costs in your area.

- Consult Professionals: For complex tax situations or significant investments, consulting with a tax advisor or financial planner can provide tailored advice and ensure you claim all eligible benefits.

- Consider All Costs: Look beyond the sticker price. Factor in potential tax credits, fuel savings, maintenance savings, and the cost of home charging installation to get a complete picture of the total cost of ownership.

By proactively engaging with this information, consumers can make informed decisions that leverage the "neg power" of current policies and technological advancements, turning potential financial drains into opportunities for savings and sustainability.

Conclusion

The concept of "neg power," far from being about negativity, is about the strategic application of forces to counteract adverse circumstances. Whether it's the fantastical "ill omens" of ancient tales or the very real financial and environmental challenges of our modern world, the ability to negate these negative impacts is a profound and beneficial capability. Electric vehicles, coupled with comprehensive tax credits, represent a tangible and accessible form of this "neg power" in action.

By embracing EVs, individuals are not only contributing to a cleaner environment but are also actively reducing their personal financial burdens through fuel savings, lower maintenance costs, and significant tax incentives. This move towards sustainable transportation is a powerful step towards greater economic freedom and resilience. We encourage you to explore the possibilities that electric vehicles offer. Research the available tax credits, visit fueleconomy.gov for qualified vehicles, and consider how harnessing this "neg power" can transform your financial future and contribute to a healthier planet. Share your thoughts in the comments below or explore other articles on our site for more insights into sustainable living and smart financial decisions.

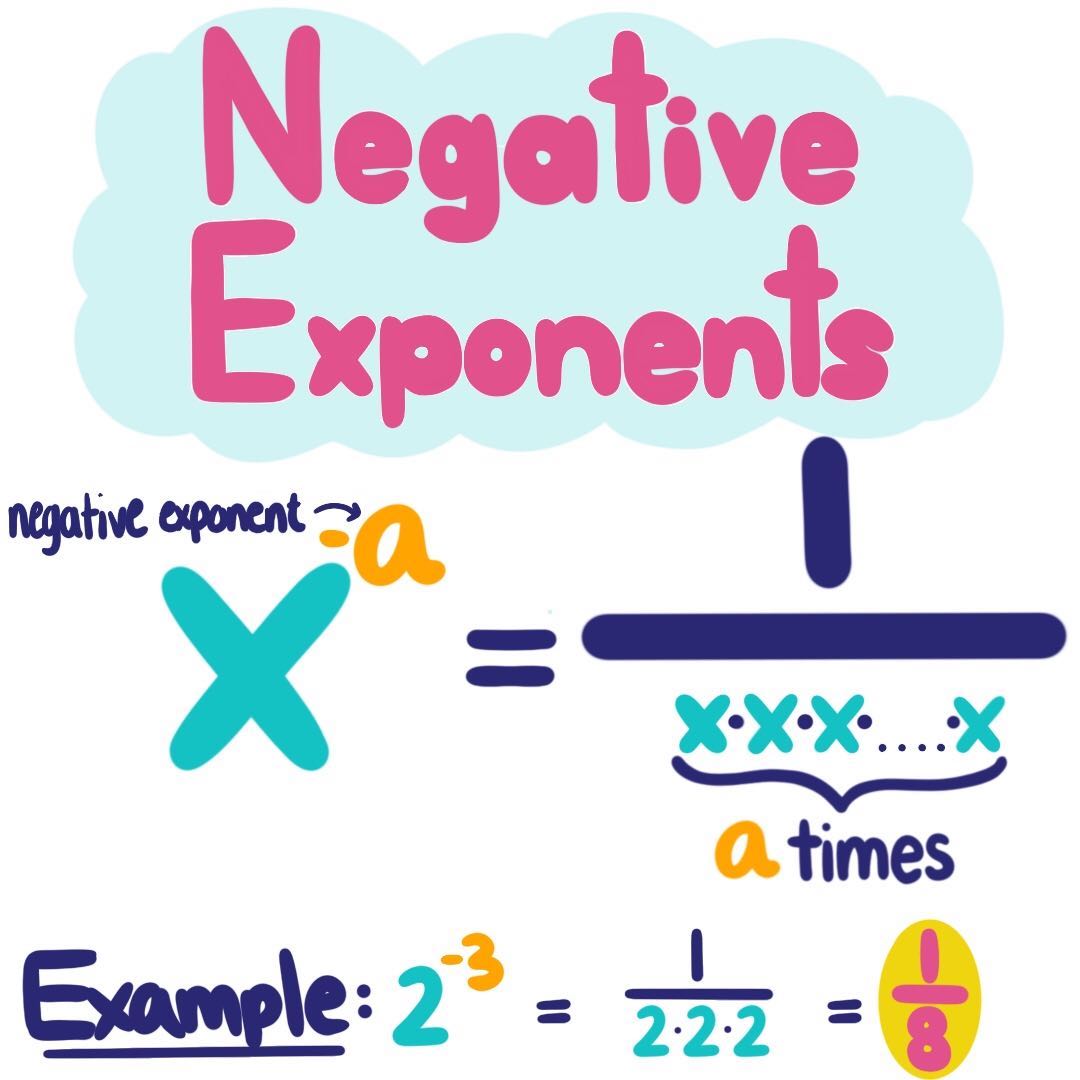

Negative Exponents — Rules & Examples - Expii

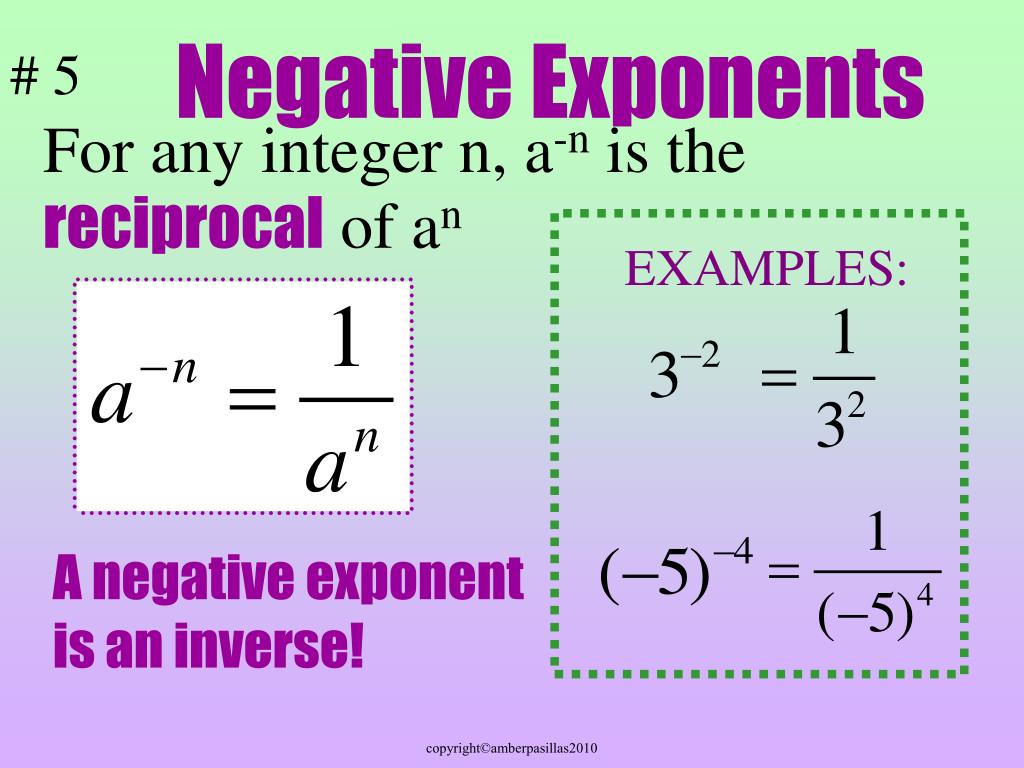

PPT - Negative Exponents PowerPoint Presentation, free download - ID

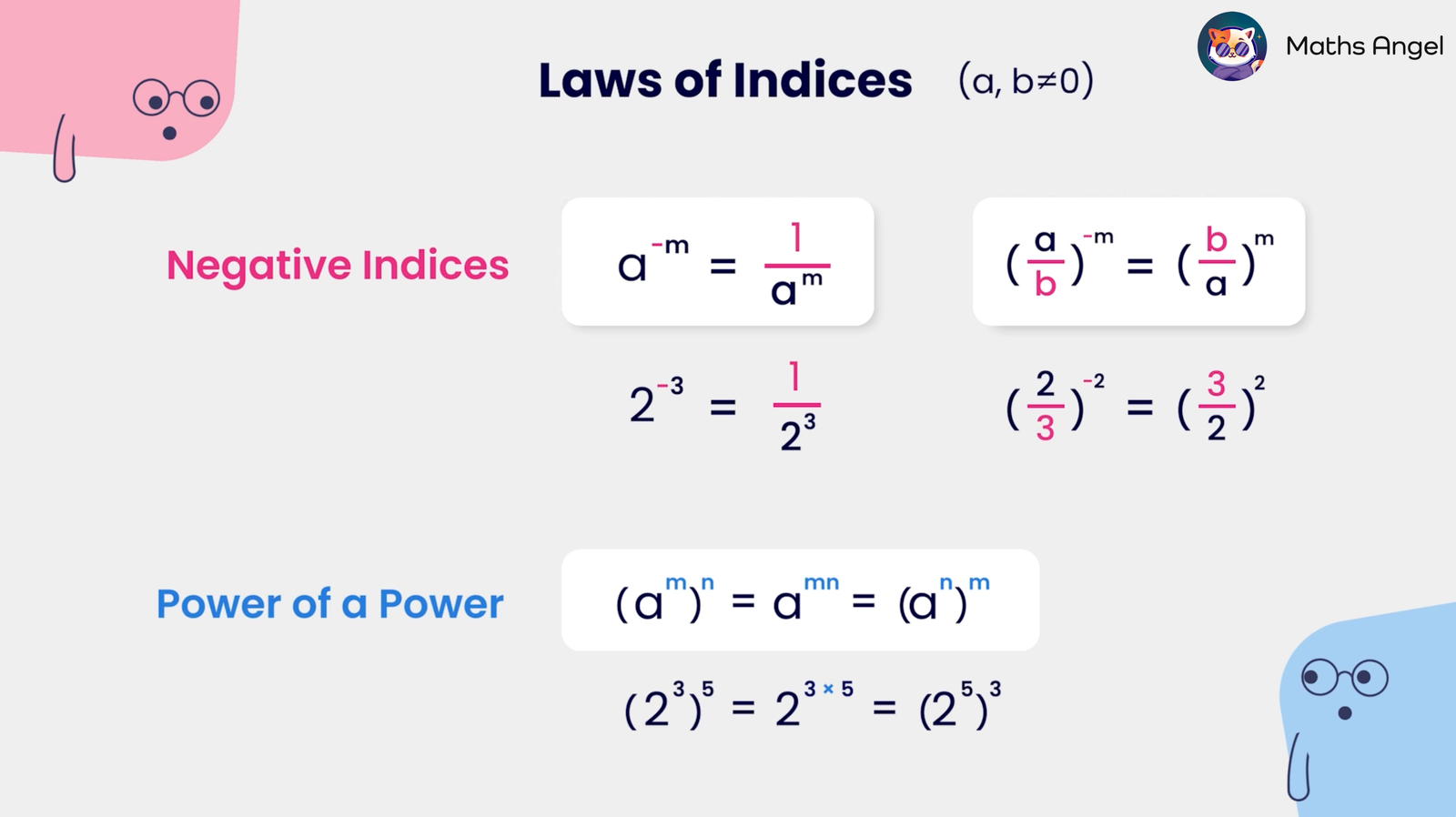

Negative Indices and Power of a Power - Formulas & Examples