Unlocking Insights: The Nancy Pelosi Portfolio Tracker Explained

Table of Contents

- Who is Nancy Pelosi?

- Understanding the Nancy Pelosi Portfolio Tracker

- Nancy Pelosi's Investment Philosophy and Key Holdings

- The Rationale Behind Tracking Congressional Investments

- Legislative Framework: The STOCK Act and Beyond

- Analyzing Performance: The Pelosi Portfolio's Edge

- Accessing and Utilizing Nancy Pelosi Portfolio Trackers

- Conclusion

Who is Nancy Pelosi?

Before diving into her investment portfolio, it's essential to understand who Nancy Pelosi is and why her financial activities garner such widespread attention. Nancy Pelosi, born in Baltimore, Maryland, is one of the most influential figures in modern American politics. Her career spans decades, marked by significant legislative achievements and a trailblazing path for women in leadership.Early Life and Political Ascent

Pelosi graduated from the Institute of Notre Dame. Her political journey began in California, where she steadily rose through the ranks of the Democratic Party. In 2002, she became a party leader, a role in which she demonstrated exceptional fundraising prowess, raising over $700 million for the Democratic Party since then. This fundraising ability, combined with her strategic political acumen, cemented her status as a formidable force in Washington. Her ascent culminated in her becoming the first female Speaker of the House of Representatives, a position she held for multiple terms, making her the highest-ranking female politician in U.S. history at the time.Key Political Achievements

As Speaker, Pelosi played a pivotal role in passing landmark legislation, including the Affordable Care Act, the American Recovery and Reinvestment Act, and various initiatives aimed at addressing climate change and economic inequality. Her political career has been characterized by a strong commitment to progressive ideals and a relentless drive to achieve her legislative goals. Given her extensive influence and access to high-level information, it's perhaps unsurprising that her personal financial dealings would become a subject of intense public and investor scrutiny. Here's a brief overview of her personal and political data:| Category | Detail |

|---|---|

| Full Name | Nancy Patricia D'Alesandro Pelosi |

| Born | Baltimore, Maryland, U.S. |

| Education | Institute of Notre Dame |

| Political Party | Democratic |

| Prominent Role | Former Speaker of the U.S. House of Representatives |

| Fundraising (since 2002 as party leader) | Over $700 million for Democratic Party |

Understanding the Nancy Pelosi Portfolio Tracker

The concept of a **Nancy Pelosi Portfolio Tracker** refers to online tools and platforms that allow the public to monitor the stock holdings and trading activities of former House Speaker Nancy Pelosi. These trackers compile information from her disclosed trades and annual filings, which are mandated by law for members of Congress. The primary purpose of these trackers is to provide transparency, allowing anyone to view her investment decisions, portfolio allocation, and even historical stock and option trades. The interest in tracking Pelosi's portfolio stems from several factors. Firstly, as a prominent figure with deep ties to policymaking, there's a natural curiosity about how her financial decisions align with, or potentially benefit from, her political knowledge. Secondly, the sheer volume and often timely nature of her trades have led some retail investors to attempt to "front-run" or mimic her investments, operating under the assumption that she (or her spouse, whose trades are also disclosed) might have an informational edge. The data compiled by these trackers includes details such as specific stock purchases, sales, options contracts, and the dates of these transactions. This level of detail offers a fascinating, albeit controversial, window into the financial world of a top politician.Nancy Pelosi's Investment Philosophy and Key Holdings

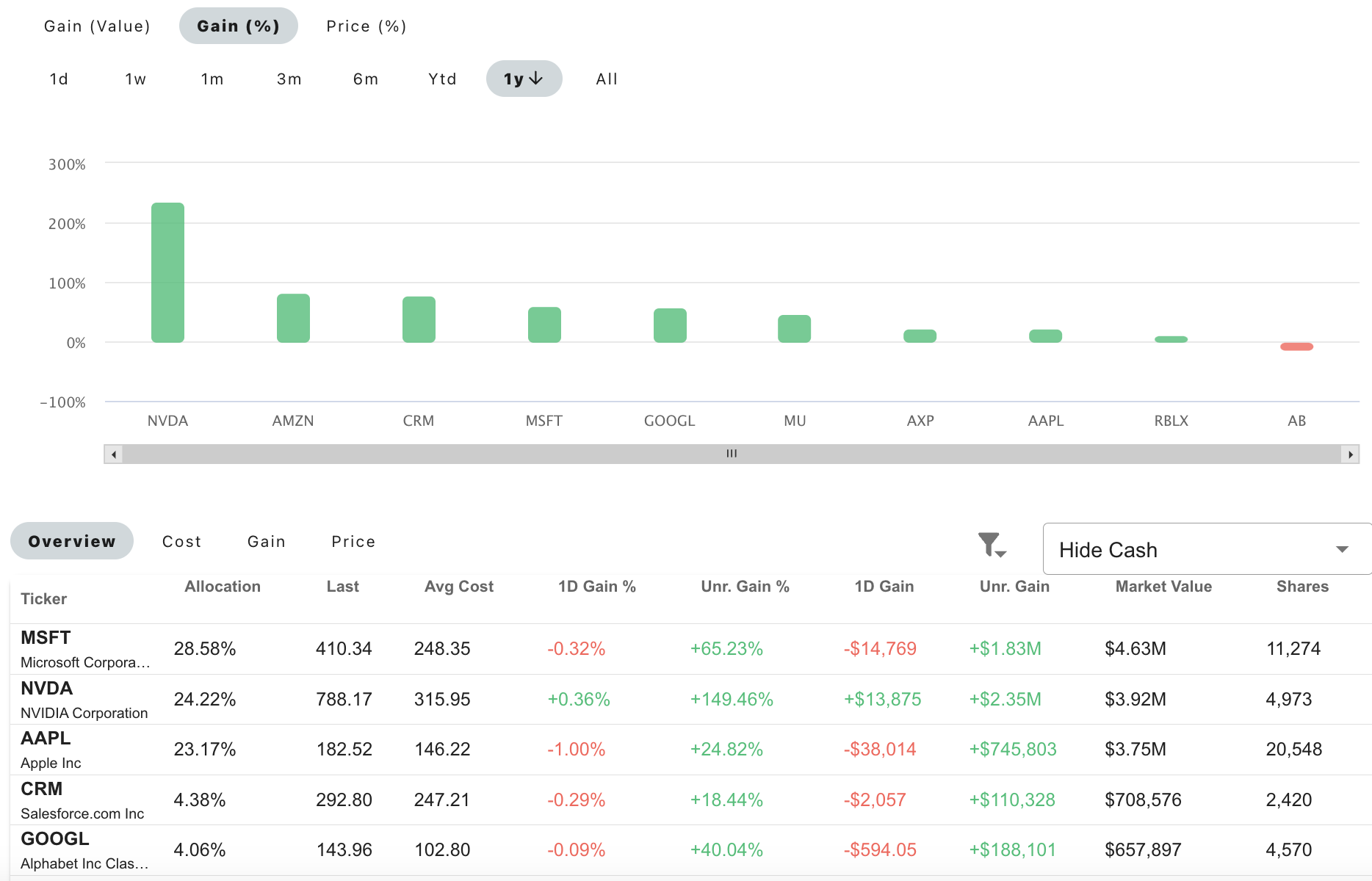

Analyzing the data provided by various **Nancy Pelosi Portfolio Tracker** tools reveals a discernible investment strategy, particularly concerning her focus on specific sectors. Her portfolio is often characterized by a strong inclination towards companies at the forefront of technological innovation and growth.Strategic Focus on Emerging Tech

Nancy Pelosi’s investment strategy reveals a laser focus on companies leading the AI revolution and other cutting-edge technologies. This strategic alignment suggests an understanding of future market trends and sectors poised for significant growth. The **Nancy Pelosi stock tracker portfolio** frequently includes tech giants and innovative firms, indicating a belief in their long-term potential. This focus is particularly interesting given the rapid advancements in artificial intelligence and its increasing integration across various industries.Recent Notable Trades

Specific examples from her disclosed trades highlight this tech-centric approach. For instance, the Nancy Pelosi stock tracker portfolio has included prominent names such as Alphabet (Google's parent company), Amazon, Tempus AI, Vistra, and Broadcom. These are all companies either deeply embedded in the technology sector or poised to benefit significantly from technological advancements. A notable recent trade mentioned in the data is Pelosi's purchase in January 2025 of 50 Amazon call options with a strike price of $150 that expire in a specific timeframe. Such option trades indicate a bullish outlook on the underlying stock, suggesting an expectation of price appreciation. Furthermore, her investment in Databricks, a data and AI company, underscores her portfolio's alignment with the AI revolution. These specific trades are closely watched by those utilizing the **Nancy Pelosi Portfolio Tracker** to glean insights into market movements.The Rationale Behind Tracking Congressional Investments

The intense public interest in the financial activities of politicians, particularly those like Nancy Pelosi, goes beyond mere curiosity. There are several compelling reasons why individuals and organizations choose to track congressional investments. Firstly, it's about transparency and accountability. In a democratic society, citizens have a right to know about the financial dealings of their elected representatives, especially when those dealings could intersect with their legislative duties. Tracking allows for public oversight, ensuring that politicians are not using their positions for personal financial gain or acting on insider information. Secondly, for some investors, it's a speculative strategy. The idea is that politicians, especially those in leadership positions, may have access to information about upcoming legislation, policy changes, or economic trends before the general public. This "informational edge" could potentially lead to highly profitable trades. While this is a contentious point and often subject to ethical debate, the perceived success of some congressional portfolios, including Nancy Pelosi's, fuels this interest. Thirdly, it highlights potential conflicts of interest. If a politician invests heavily in a particular industry, and then votes on legislation that benefits that industry, it raises questions about whether their decisions are truly in the public interest or influenced by personal financial motives. Trackers help identify such patterns, prompting discussions about ethics reform. Finally, it's a form of market intelligence, albeit an unconventional one. While not a substitute for fundamental or technical analysis, some view congressional trading patterns as an additional data point, reflecting potential shifts in economic or industry landscapes that might be influenced by policy.Legislative Framework: The STOCK Act and Beyond

The scrutiny over congressional stock trading is not new, and it led to significant legislative action. The Stop Trading on Congressional Knowledge (STOCK) Act, signed into law in 2012, was a direct response to concerns about insider trading by members of Congress. Per the STOCK Act, members of Congress are required to file public reports of their stock transactions within a specific timeframe (usually 45 days after the trade). This legislation was designed to increase transparency and deter the use of non-public information for personal profit. It mandates that politicians disclose their trading activity, portfolio, net worth, corporate donors, and more, making much of the data used by the **Nancy Pelosi Portfolio Tracker** publicly accessible. Despite the STOCK Act, debates continue about its effectiveness and whether further measures are needed. Concerns persist about the potential for members of Congress to gain an unfair advantage. Former House Speaker Nancy Pelosi herself acknowledged these concerns, stating back in 2022 that the Senate would soon vote on a bill banning members of Congress from trading individual stocks. This ongoing discussion reflects a broader societal demand for greater integrity and fairness in both politics and financial markets. The existence and popularity of tools like the **Nancy Pelosi stock trades tracker** underscore the public's desire for real-time insight into these financial disclosures.Analyzing Performance: The Pelosi Portfolio's Edge

One of the most captivating aspects of the discussion around the **Nancy Pelosi Portfolio Tracker** is the reported performance of her investments. Anecdotal evidence and some analyses suggest that her portfolio has, at times, demonstrated remarkable returns, leading to claims that her investments have outperformed even seasoned market veterans. A striking piece of data from the provided information states: "Nancy Pelosi's investments over 11 years have outperformed the 'oracle of Omaha', Warren Buffett's Berkshire Hathaway." This is a significant claim, as Warren Buffett is widely regarded as one of the most successful investors of all time. If true, it implies a highly effective investment strategy, or perhaps, a unique informational advantage. However, it's crucial to approach such claims with caution and a balanced perspective, especially when discussing YMYL topics like investments. While the data may reflect reported performance, several factors contribute to investment success, and past performance is never an indicator of future results. The specific timing of trades, the inherent volatility of certain sectors (like technology), and the general market conditions during the period in question all play a role. The reported outperformance could be due to a combination of strategic foresight, opportune timing, and perhaps, the sheer luck that can influence even the most sophisticated portfolios. It also prompts further questions about the ethical implications if such outperformance is consistently tied to legislative developments. The very existence of such a claim highlights why the **Nancy Pelosi Portfolio Tracker** remains a subject of intense scrutiny and fascination for investors.Accessing and Utilizing Nancy Pelosi Portfolio Trackers

For those interested in delving deeper into the investment activities of Nancy Pelosi and other members of Congress, a variety of online tools and platforms have emerged. These **Nancy Pelosi stock trackers** are designed to aggregate and present the publicly available disclosure data in an accessible format. These online tools allow users to:- **Track Nancy Pelosi's current stock portfolio and allocation**, based on their disclosed trades and annual filings.

- **View all of Nancy Pelosi's latest filings** as well as historical stock and option trades.

- **Receive notifications** when new reports are uploaded, ensuring users stay updated on recent transactions.

- **Search by politician or stock**, allowing for targeted research into specific investments or the activities of other congressional members.

- **See the most active traders** in the Senate and House of Representatives, providing a broader view of congressional investment trends.

Conclusion

The **Nancy Pelosi Portfolio Tracker** represents more than just a tool for monitoring stock trades; it embodies a broader conversation about transparency, ethics, and the intersection of politics and finance. From her strategic focus on AI and tech giants to the reported outperformance of her investments, Nancy Pelosi's portfolio has undeniably captured the attention of retail investors and policy watchdogs alike. The legislative framework, particularly the STOCK Act, aims to ensure accountability, yet the ongoing debate about congressional stock trading highlights a persistent public demand for even greater scrutiny. While tracking congressional portfolios can offer intriguing insights into market trends and potential policy impacts, it's crucial for individuals to conduct their own thorough research and consult with financial professionals before making any investment decisions. The information presented by these trackers is for informational purposes and should not be construed as financial advice. The phenomenon of the **Nancy Pelosi Portfolio Tracker** serves as a powerful reminder of the intricate connections between Washington D.C. and Wall Street, and the public's enduring interest in ensuring that those in power operate with the utmost integrity. What are your thoughts on congressional stock trading? Do you think current regulations are sufficient, or is a complete ban on individual stock trading for members of Congress necessary? Share your opinions in the comments below, and don't forget to explore our other articles on market transparency and investment strategies.

Nancy Pelosi Portfolio Tracker @Naney Tracker Annualized returns of the

Optimizing Nancy Pelosi's Stock Portfolio in Python (1400% Return Over

Nancy Pelosi Stock Portfolio Performance 2024