Secure Your Transactions: The Indispensable Role Of Card Validators

In today's fast-paced digital landscape, where transactions occur at the speed of light, the integrity and security of every payment are paramount. This is precisely where the unsung hero, the card validator, steps in. More than just a simple check, a robust card validation system is the bedrock of secure financial interactions, protecting both businesses and consumers from the ever-present threat of fraud and ensuring seamless, trustworthy commerce.

From online shopping sprees to in-store purchases, the journey of a payment card number is fraught with potential pitfalls. Without rigorous validation, businesses risk substantial financial losses, reputational damage, and a loss of customer trust. For consumers, the peace of mind that comes from knowing their financial data is protected is invaluable. Understanding how these systems work and why they are crucial is no longer just for financial professionals; it's essential knowledge for anyone participating in the digital economy.

Table of Contents

- Understanding the Core: What is a Card Validator?

- Why Card Validation is Non-Negotiable in Today's Digital Economy

- Different Types of Card Validators and Their Applications

- The Benefits of Implementing Robust Card Validation Systems

- Navigating the Challenges: Common Issues and Solutions

- Choosing the Right Card Validator for Your Needs

- The Broader Spectrum of Validation: Lessons from Digital Integrity

- The Future of Card Validation: AI, Biometrics, and Beyond

Understanding the Core: What is a Card Validator?

At its heart, a card validator is a sophisticated tool or system designed to verify the authenticity and validity of payment card details before a transaction is processed. This validation process is a critical first line of defense against fraudulent activities, ensuring that the card number, expiration date, and security codes (like CVV/CVC) are legitimate and correctly formatted. It's not merely about checking if the numbers exist; it's about confirming they conform to established industry standards and have not been flagged as compromised or invalid. The process of validation typically occurs in real-time, often within milliseconds, as soon as a customer enters their card details online or swipes/taps their card at a physical point-of-sale (POS) terminal. This instantaneous check prevents invalid transactions from ever reaching the payment gateway, saving businesses from chargebacks, fees, and the administrative burden of resolving fraudulent purchases. It's a foundational element of secure payment processing, working silently in the background to maintain the integrity of countless daily transactions.Beyond Basic Checks: The Mechanics of Validation

The mechanics behind a reliable card validator are more intricate than a simple number match. These systems employ a combination of algorithms, database lookups, and industry-specific rules to perform a multi-layered verification. Key aspects checked include: * **Card Number Format:** Each card type (Visa, MasterCard, American Express, etc.) has a specific numbering structure, including the length of the number and the starting digits (known as the Bank Identification Number or BIN). A validator immediately checks if the entered number adheres to these established patterns. * **Expiration Date:** The system verifies that the card has not expired. This is a straightforward yet crucial check to prevent transactions with invalid cards. * **Security Codes (CVV/CVC/CID):** These three or four-digit codes, typically found on the back or front of the card, provide an additional layer of security. While the validator doesn't store these codes, it can confirm their presence and sometimes their format, depending on the integration. * **BIN (Bank Identification Number) Lookup:** The first few digits of a card number (typically the first six) identify the issuing bank. A sophisticated card validator can perform a BIN lookup to identify the card type, issuing bank, and even the country of origin. This information is vital for fraud detection, as it can flag inconsistencies (e.g., a card issued in one country being used for a high-value purchase in another without prior travel notification).The Luhn Algorithm: A Foundational Check

Central to the initial validation of most payment card numbers is the Luhn algorithm, also known as the "modulus 10" algorithm. This simple checksum formula is used to validate a variety of identification numbers, including credit card numbers, IMEI numbers, and Canadian Social Insurance Numbers. It's not a cryptographic security feature but rather a quick way to detect common errors, such as mistyped digits, before a transaction is even sent for authorization. Here's how the Luhn algorithm generally works: 1. Starting from the rightmost digit (the checksum digit), move left, doubling the value of every second digit. 2. If doubling a digit results in a two-digit number (e.g., 6 doubled is 12), sum the digits of that two-digit number (e.g., 1+2=3). 3. Sum all the digits (original and modified). 4. If the total sum is a multiple of 10 (i.e., ends in zero), then the number is valid according to the Luhn algorithm. While the Luhn algorithm is effective at catching simple transcription errors, it does not guarantee the card number is active or belongs to a real person. It's merely a preliminary check, but an essential one, ensuring that the number structure itself is plausible.Why Card Validation is Non-Negotiable in Today's Digital Economy

The importance of a robust card validator cannot be overstated in an era where digital transactions dominate. The financial landscape is constantly evolving, bringing with it both innovation and new threats. For businesses, implementing a reliable card validation system is not just good practice; it's a fundamental requirement for survival and growth.Combating Fraud: Protecting Your Business and Customers

Fraud is a pervasive and costly problem for businesses worldwide. According to various industry reports, e-commerce fraud alone accounts for billions of dollars in losses annually. Fraudulent transactions lead to: * **Direct Financial Losses:** Businesses lose the revenue from the sale and often the product itself if it has already been shipped. * **Chargeback Fees:** When a legitimate cardholder disputes a fraudulent charge, the merchant is hit with a chargeback fee from their bank, which can range from $20 to $100 per incident, regardless of the transaction value. * **Increased Processing Costs:** A high chargeback rate can lead to higher processing fees from payment gateways and acquiring banks, or even the termination of merchant accounts. * **Reputational Damage:** Customers who experience fraud on a merchant's platform are unlikely to return, and negative word-of-mouth can severely impact brand trust. A proactive card validator significantly mitigates these risks by identifying and rejecting invalid or suspicious card details at the point of entry. This prevents fraudulent transactions from ever entering the payment ecosystem, saving businesses considerable time, money, and stress. It acts as a gatekeeper, ensuring only legitimate payment attempts proceed.Ensuring Compliance and Building Trust

Beyond fraud prevention, card validation plays a crucial role in maintaining compliance with industry standards and regulations, most notably the Payment Card Industry Data Security Standard (PCI DSS). While the validator itself doesn't directly handle sensitive data storage, its role in ensuring data integrity at the input stage contributes to a secure processing environment. Adherence to PCI DSS is mandatory for any entity that stores, processes, or transmits cardholder data, and failing to comply can result in hefty fines and severe penalties. Furthermore, implementing transparent and effective security measures, including card validation, builds immense trust with customers. In an age where data breaches are common news, consumers are increasingly wary about sharing their financial information online. Businesses that demonstrate a clear commitment to security, by using reliable validation tools, reassure their customers that their sensitive data is handled with the utmost care. This trust translates into repeat business, customer loyalty, and a stronger brand reputation.Different Types of Card Validators and Their Applications

The functionality of a card validator can be implemented in various forms, each suited to different business needs and operational environments. * **Online Tools:** Many websites offer free, simple online card validators where users can manually enter a card number to check its format validity (often using the Luhn algorithm). These are useful for quick, ad-hoc checks but are not suitable for integrating into a live payment system due to security and scalability concerns. * **API Integrations:** This is the most common and robust form of card validation for e-commerce and online services. Payment gateways and dedicated fraud prevention services offer APIs (Application Programming Interfaces) that allow businesses to seamlessly integrate validation checks directly into their websites or applications. When a customer enters card details, the data is sent to the API for real-time validation before being sent for authorization. This method offers speed, scalability, and enhanced security features like BIN lookups and advanced fraud scoring. * **Point-of-Sale (POS) Systems:** In physical retail environments, POS terminals often have built-in validation capabilities. When a card is swiped, inserted, or tapped, the POS system performs initial checks on the card's format and expiration date before sending the transaction to the payment processor. While less complex than online API integrations, these on-device validators are crucial for preventing basic errors and ensuring the physical card is valid. Each type serves a specific purpose, but the underlying goal remains the same: to ensure the legitimacy of the payment instrument at the earliest possible stage.The Benefits of Implementing Robust Card Validation Systems

The advantages of integrating a sophisticated card validator into your payment infrastructure extend far beyond mere compliance, touching every aspect of business operations and customer relations. * **Reduced Chargebacks and Financial Losses:** This is arguably the most significant benefit. By catching invalid or fraudulent card details upfront, businesses drastically reduce the number of chargebacks they face. This directly translates to saving money on lost revenue, chargeback fees, and the administrative costs associated with disputing fraudulent claims. * **Enhanced Customer Experience:** While security is paramount, it shouldn't come at the cost of convenience. A well-implemented card validator works silently and swiftly, ensuring that legitimate customers experience smooth, uninterrupted transactions. They are spared the frustration of failed payments due to simple input errors, leading to a more positive shopping experience and increased customer satisfaction. * **Streamlined Operations:** Automated card validation reduces the need for manual review of suspicious transactions, freeing up valuable staff time. It also simplifies reconciliation processes and reduces the complexity of fraud management, allowing businesses to focus on core activities rather than damage control. * **Improved Data Quality:** By ensuring that only correctly formatted and valid card details enter the system, businesses maintain cleaner and more reliable transaction data. This is beneficial for analytics, reporting, and future business planning. * **Protection Against Card Testing:** Fraudsters often use automated bots to "test" stolen card numbers by making small purchases on various websites. A strong card validator can detect and block these attempts before they even reach the payment gateway, protecting your business from becoming a testing ground for illicit activities.Navigating the Challenges: Common Issues and Solutions

While the benefits of card validation are clear, implementing and maintaining these systems can present certain challenges. Understanding these hurdles and their solutions is key to maximizing the effectiveness of your card validator. * **Integration Complexities:** Integrating a third-party card validation API into an existing e-commerce platform or custom application can be technically challenging. It requires developer expertise and careful planning to ensure seamless operation without disrupting the user experience. * **Solution:** Opt for validation services that offer well-documented APIs, SDKs (Software Development Kits), and comprehensive support. Consider using pre-built plugins or modules for popular e-commerce platforms like Shopify, WooCommerce, or Magento, which simplify integration. * **Keeping Up with Evolving Threats:** Fraud tactics are constantly evolving. What works today might be circumvented tomorrow. A static validation system quickly becomes obsolete. * **Solution:** Partner with a card validator provider that continuously updates its algorithms, fraud databases, and security protocols. Look for services that leverage machine learning and artificial intelligence to adapt to new fraud patterns in real-time. Regular security audits and staying informed about the latest fraud trends are also crucial. * **False Positives (Legitimate Transactions Flagged as Fraudulent):** Overly aggressive validation rules can sometimes flag legitimate transactions as suspicious, leading to customer frustration and lost sales. * **Solution:** Implement a validation system that allows for configurable rules and thresholds. Monitor your transaction data to identify patterns of false positives and adjust your validation settings accordingly. Balancing security with user experience is an ongoing process that requires careful tuning.Choosing the Right Card Validator for Your Needs

Selecting the appropriate card validator is a critical decision for any business handling online payments. It's not a one-size-fits-all solution, and the best choice will depend on your specific operational scale, transaction volume, and risk tolerance. * **Key Features to Look For:** * **Real-time Validation:** Essential for immediate feedback and preventing fraudulent transactions. * **Comprehensive Checks:** Beyond Luhn, look for BIN lookups, expiration date checks, and support for CVV/CVC verification. * **Fraud Scoring Capabilities:** Advanced validators provide a risk score for each transaction, allowing for more nuanced decision-making. * **Customizable Rules:** The ability to set specific rules based on your business's risk profile (e.g., blocking transactions from certain countries or for high-value orders). * **Integration Ease:** Well-documented APIs, SDKs, and compatibility with your existing payment gateway or e-commerce platform. * **Reporting and Analytics:** Tools to monitor validation success rates, identify fraud patterns, and track performance. * **PCI DSS Compliance:** Ensure the provider adheres to the highest security standards. * **Scalability and Support:** As your business grows, your validation needs will too. Choose a provider that can handle increasing transaction volumes without performance degradation. Excellent customer support is also vital for troubleshooting and technical assistance. Don't hesitate to ask for case studies or client testimonials to gauge their reliability and service quality.The Broader Spectrum of Validation: Lessons from Digital Integrity

The concept of "validation" extends far beyond just payment cards. In the digital world, validation is a fundamental principle for ensuring accuracy, integrity, and reliability across various domains. Just as a card validator ensures the correctness of financial data, other types of validators play crucial roles in maintaining digital health. For instance, consider the "markup validity of web documents in HTML, XHTML, SMIL, MathML, etc." checked by tools like the W3C validator. These tools ensure that web pages are structured correctly, adhering to established standards. This prevents display errors, improves accessibility, and ensures consistent rendering across different browsers. Similarly, "JSON validators" and "XML validators" ensure that data structures are correctly formatted, preventing parsing errors and ensuring smooth data exchange between systems. Even "digital certificate validators" verify the authenticity of digital identities, crucial for secure communication and government services. The common thread among all these validators is the commitment to correctness and trust. They act as guardians of data integrity, whether it's the code that builds a website, the structure of data being exchanged, or the financial information in a payment transaction. When seeking information or solutions, platforms like Zhihu (知乎) in China, known for its high-quality Q&A community, or Baidu Knows (百度知道), a leading Chinese Q&A platform, highlight the universal human need for reliable, validated information. Just as these platforms strive to provide trustworthy answers, a card validator strives to provide trustworthy transactions. This broader understanding underscores that validation, in its many forms, is an indispensable pillar of the modern digital ecosystem, fostering reliability and security in every interaction.The Future of Card Validation: AI, Biometrics, and Beyond

The landscape of payment security is dynamic, and the future of the card validator is set to be even more sophisticated and integrated. Emerging technologies are poised to revolutionize how we verify transactions, making them more secure and seamless. * **Artificial Intelligence (AI) and Machine Learning (ML):** AI and ML are already playing a significant role in fraud detection, and their capabilities will only grow. These technologies can analyze vast datasets of transaction patterns, identify anomalies in real-time, and predict fraudulent behavior with increasing accuracy. Future card validators will likely be powered by advanced AI models that learn and adapt to new fraud schemes autonomously. * **Biometric Authentication:** Fingerprint scans, facial recognition, and iris scans are becoming more common for unlocking devices and authenticating identity. Integrating biometrics directly into the payment process could provide an extremely secure layer of validation, linking the transaction directly to the legitimate cardholder's unique biological data. * **Tokenization and Encryption:** While not directly part of the "validator" itself, the continued evolution of tokenization (replacing sensitive card data with unique, non-sensitive tokens) and advanced encryption methods will further reduce the risk associated with handling actual card numbers, making the validation process inherently more secure. * **Behavioral Analytics:** Future validators may incorporate behavioral analytics, studying how a user interacts with a website or app (e.g., typing speed, mouse movements) to identify patterns that suggest fraudulent activity, adding another subtle layer of real-time validation. These advancements promise a future where card validation is not just about checking numbers but about understanding the entire context of a transaction and the behavior of the user, leading to a truly intelligent and adaptive security framework.Conclusion

The card validator, though often operating behind the scenes, is an indispensable component of modern digital commerce. Its role in preventing fraud, ensuring compliance, and building customer trust cannot be overstated. From the foundational Luhn algorithm to sophisticated AI-driven systems, these tools are constantly evolving to meet the escalating challenges of online security. For businesses, investing in a robust card validation system is not an expense, but a strategic imperative that safeguards revenue, reputation, and customer loyalty. As the digital economy continues its rapid expansion, the integrity of every transaction becomes even more critical. By understanding the importance of card validation and implementing the right solutions, businesses can foster a secure environment where innovation thrives and consumers can transact with confidence. What are your experiences with card validation? Have you ever encountered a fraudulent attempt that was blocked by a validator? Share your thoughts and insights in the comments below, or explore our other articles on payment security to further enhance your knowledge and protect your business in the digital age.

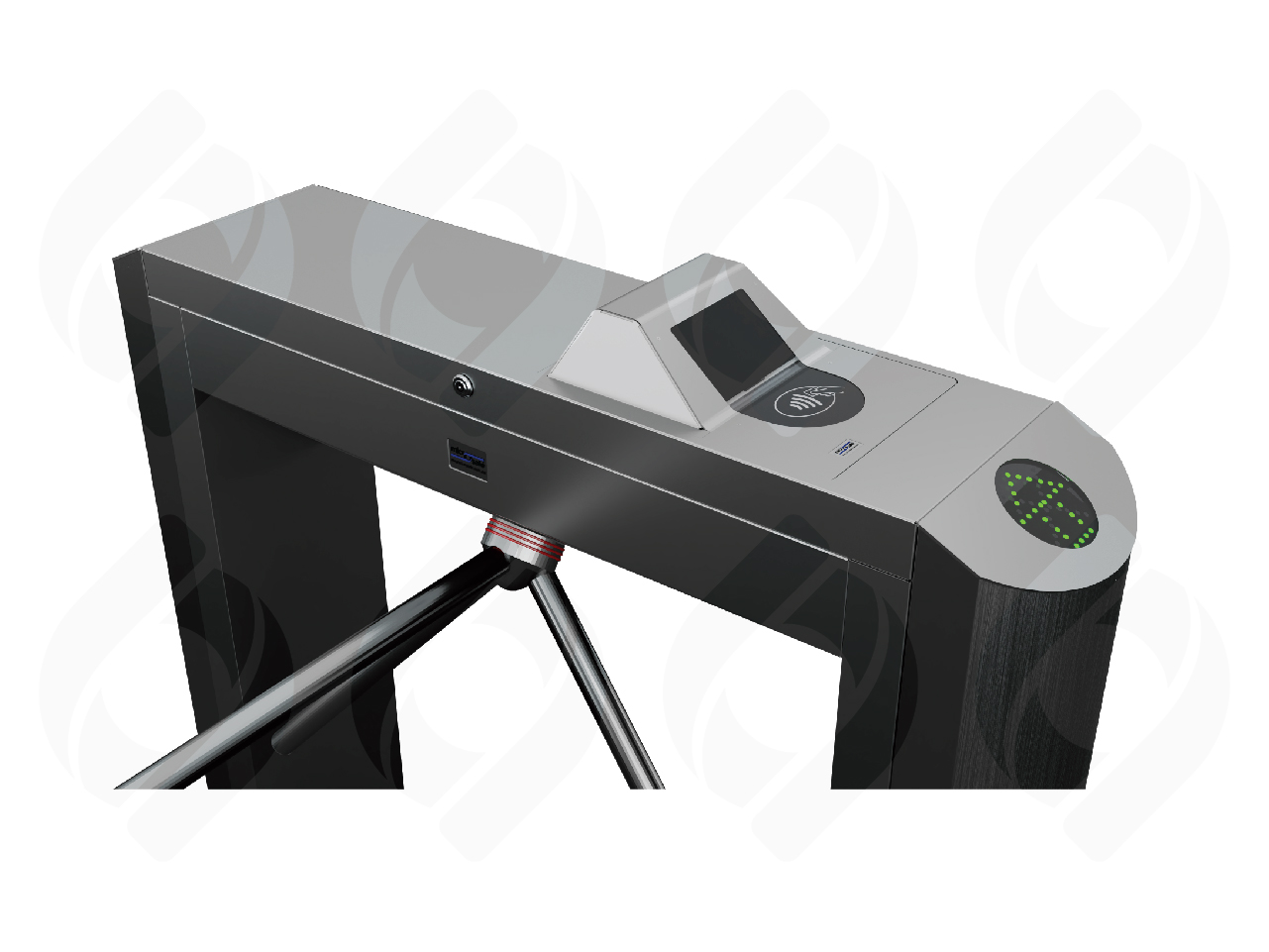

Validador de Tarjetas sin Contacto| Validador Contactless

Validador de Tarjetas sin Contacto| Validador Contactless

Validador de Tarjetas sin Contacto| Validador Contactless