Stanphyl Capital: Unpacking Mark Spiegel's Contrarian Investment Philosophy

In the dynamic and often unpredictable world of finance, certain names emerge not just for their performance, but for their distinctive approach and outspoken views. One such entity is Stanphyl Capital, a hedge fund that has carved out a notable niche through its contrarian investment strategies and the vocal insights of its founder, Mark Spiegel. This article delves deep into Stanphyl Capital, exploring its origins, its unique investment philosophy, its remarkable performance, and the compelling personality behind its operations, offering a comprehensive look for those seeking to understand a truly independent voice in the investment landscape.

For investors and market observers alike, understanding the mechanisms and mindsets behind successful funds is paramount. Stanphyl Capital stands as a testament to the power of conviction, particularly when it goes against prevailing market sentiment. From its New York base, this equity long/short hedge fund has consistently demonstrated a willingness to challenge conventional wisdom, making it a fascinating subject for anyone interested in high-stakes investing and the personalities that shape it.

Table of Contents

- The Genesis of Stanphyl Capital: A Visionary Foundation

- Stanphyl Capital's Investment Philosophy: Long/Short Equity and Beyond

- Navigating Volatility: Stanphyl Capital's Performance Highlights

- The Voice of Stanphyl: Insights from Mark Spiegel's Twitter

- The Contrarian Edge: Why Stanphyl Capital Stands Out

- Understanding Hedge Funds: The Stanphyl Capital Model

- The Importance of Due Diligence in Investment Decisions

- Beyond the Numbers: Stanphyl Capital's Broader Market Commentary

- Conclusion: The Enduring Legacy of Stanphyl Capital

The Genesis of Stanphyl Capital: A Visionary Foundation

Every successful investment firm has a foundational story, and for Stanphyl Capital, it begins with its founder, Mark Spiegel. The fund was established in 2011, a period following significant global financial upheaval, which arguably provided fertile ground for new approaches to market analysis and investment. Prior to launching his own hedge fund, Mark Spiegel honed his skills and gained invaluable experience in various facets of the financial industry. He spent six years as an investment banker, primarily focused on financing public companies. This background provided him with a deep understanding of corporate finance, capital structures, and the intricacies of bringing companies to the public market.

His diverse experiences, including working for a public company itself, equipped him with a holistic perspective on business operations and market dynamics. This blend of banking and corporate experience laid a robust groundwork for the analytical rigor and strategic thinking that would become hallmarks of Stanphyl Capital. The decision to launch his own hedge fund, Stanphyl Capital Partners, LP, was a natural progression for someone with Spiegel's deep market insights and a clear vision for how to generate returns, particularly through a contrarian lens.

Mark Spiegel: A Profile in Contrarian Investing

Mark Spiegel is not just the managing member and portfolio manager of Stanphyl Capital Partners; he is the embodiment of its investment philosophy. Known for his outspoken views and contrarian investment strategies, Spiegel has built a reputation as a fearless commentator and a shrewd investor willing to bet against the crowd. His approach is often characterized by meticulous research and a willingness to publicly articulate his dissenting opinions, even when they challenge popular narratives or powerful figures.

His public persona, particularly his active presence on platforms like Twitter, serves as an extension of Stanphyl Capital's transparency and commitment to sharing insights. Spiegel's willingness to engage in public discourse, often with sharp wit and unwavering conviction, has made him a distinctive voice in the financial community. This blend of deep analytical prowess and a bold, public communication style defines Mark Spiegel and, by extension, the identity of Stanphyl Capital.

| Attribute | Detail |

|---|---|

| Name | Mark Spiegel |

| Role | Managing Member and Portfolio Manager, Stanphyl Capital Partners |

| Fund Founded | 2011 |

| Prior Experience | Six years as an investment banker financing public companies; worked for a public company. |

| Known For | Outspoken views, contrarian investment, vociferous Tesla short seller. |

| Fund Type | Equity Long/Short Hedge Fund |

| Fund Location | New York, New York, United States |

Stanphyl Capital's Investment Philosophy: Long/Short Equity and Beyond

At its core, Stanphyl Capital Partners Fund operates as an equity long/short hedge fund. This means the fund takes both "long" positions (buying stocks with the expectation they will rise in value) and "short" positions (selling borrowed stocks with the expectation they will fall, aiming to buy them back at a lower price). This dual strategy allows the fund to potentially profit in both rising and falling markets, providing a degree of flexibility and risk management that pure long-only funds do not possess.

The "short" side of Stanphyl Capital's strategy is particularly noteworthy, as it often involves taking significant positions against companies that Mark Spiegel believes are fundamentally overvalued or have unsustainable business models. This contrarian stance is not merely speculative; it is rooted in deep fundamental analysis and a willingness to challenge consensus. While many investors prefer to focus solely on identifying winners, Stanphyl Capital also excels at identifying potential losers, a skill that proved immensely profitable in certain market conditions.

Beyond the long/short mechanics, Stanphyl Capital's philosophy is deeply influenced by Spiegel's critical thinking. His insights, opinions, and updates on various topics, including finance, technology, and current events, are regularly shared, reflecting a broad intellectual curiosity that informs the fund's investment decisions. This holistic view allows Stanphyl Capital to identify macro trends and specific company vulnerabilities that might be overlooked by others.

Navigating Volatility: Stanphyl Capital's Performance Highlights

The true measure of an investment fund lies in its performance, and Stanphyl Capital has demonstrated a remarkable ability to generate significant returns, particularly in challenging market environments. The fund's strategic bets and contrarian positions have often paid off handsomely, solidifying its reputation as a shrewd operator in the hedge fund space.

The Tesla Short: A Defining Bet

Perhaps no single position has defined Stanphyl Capital's public image and performance as much as its vociferous short-selling of Tesla. Mark Spiegel has long been known as a prominent and outspoken Tesla short seller, consistently arguing that the company was grossly overvalued. This was not a fleeting bet but a long-term conviction, maintained even as Tesla's stock soared to dizzying heights, challenging many other short sellers to capitulate.

However, Spiegel's persistence and analytical conviction ultimately paid off. His short position in Tesla proved instrumental in helping Stanphyl Capital generate a huge return in 2022. While the broader market faced significant headwinds that year, Stanphyl Capital's strategic short positions, particularly against Tesla, allowed it to thrive. This specific success story underscores the fund's commitment to its contrarian philosophy and its ability to capitalize on perceived market irrationality.

Recent Performance Snapshots (2022-2023)

Stanphyl Capital's performance in recent years provides concrete evidence of its effective strategy. The first half of 2022 saw the Stanphyl Capital hedge fund in a roll, gaining almost 37 percent. This was a period when many indices, like the S&P 500, were experiencing significant declines, highlighting Stanphyl Capital's ability to deliver alpha (returns above a benchmark) even in bear markets.

The fund continued to show strong performance into 2023, albeit with some monthly fluctuations, which are typical for active management strategies. For instance, in April 2023, Stanphyl Capital was up 7.1 percent net of all fees and expenses. By way of comparison, the S&P 500 was up 1.6 percent during the same month, and the Russell 2000, an index of smaller companies, actually fell 1.8 percent. This stark contrast demonstrates Stanphyl Capital's capacity to outperform major market benchmarks.

However, investment is not without its dips. For July 2023, the fund was down approximately 5.3% net of fees. Such monthly fluctuations are a normal part of hedge fund operations, reflecting market volatility and the specific outcomes of individual positions. Despite this, the broader trend remained positive. By September 2023, the fund demonstrated a strong rebound, being up approximately 18.0% net of all fees and expenses. In comparison, the S&P 500 was down during September 2023, further illustrating Stanphyl Capital's uncorrelated performance and its ability to generate returns when the broader market struggles.

The Voice of Stanphyl: Insights from Mark Spiegel's Twitter

Beyond its financial statements, Stanphyl Capital's official Twitter account serves as a vital conduit for sharing Mark Spiegel's insights, opinions, and updates. This platform is not merely a marketing tool but a genuine reflection of Spiegel's analytical process and his candid views on a wide array of subjects. It's where he discusses finance, technology, current events, and often, his critiques of companies he believes are overvalued or mismanaged.

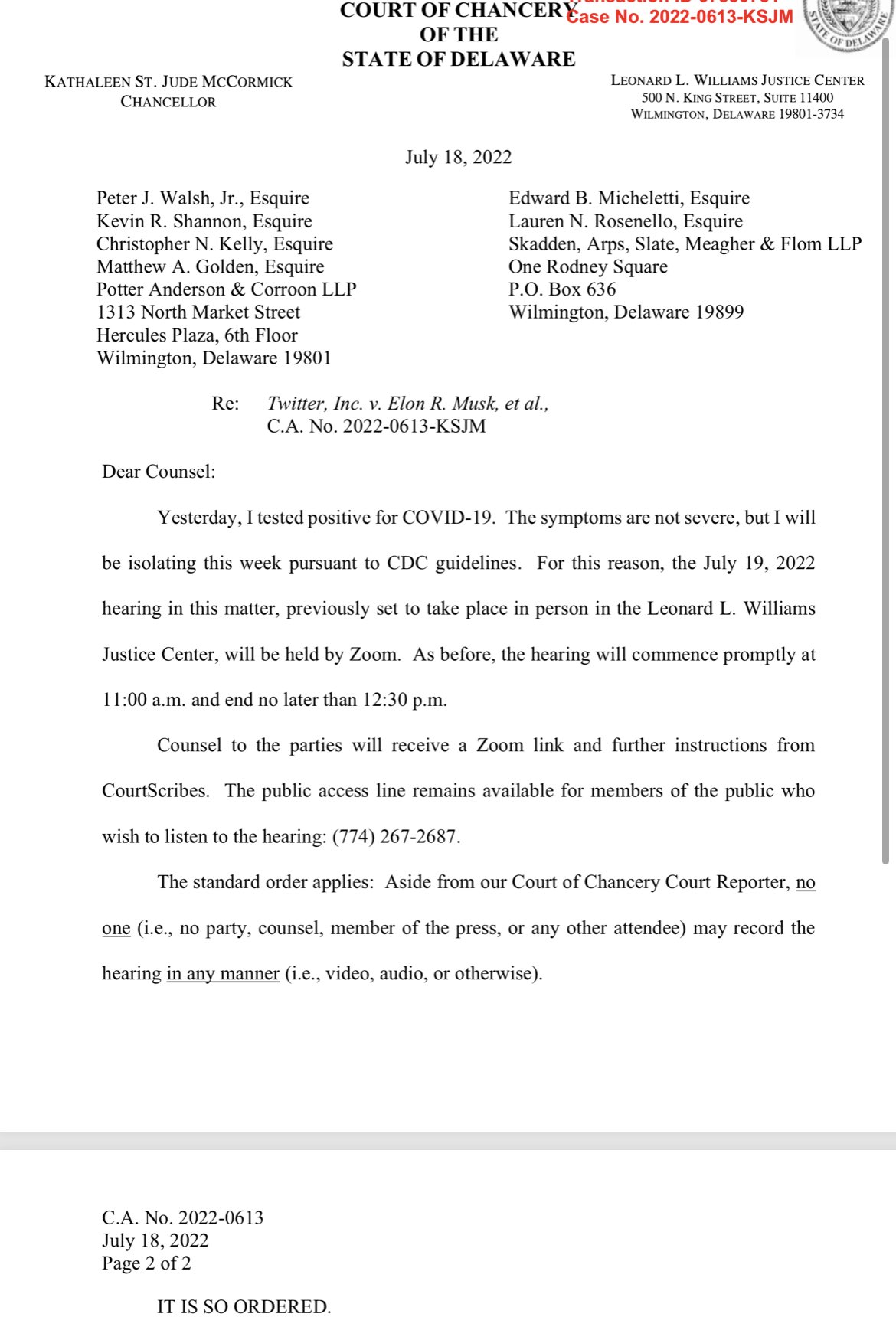

His tweets often feature sharp commentary, such as his direct challenge to Elon Musk's statements regarding government support for his companies: "When someone is wrong that often one must question either his honesty or his competence, Personally, I question both,” said Mark Spiegel of Stanphyl Capital, who is betting." This kind of direct, no-holds-barred commentary is characteristic of Spiegel and provides valuable insight into the conviction behind Stanphyl Capital's investment decisions. For those following the market, Spiegel's Twitter offers a unique, unfiltered perspective that often contrasts sharply with mainstream narratives, providing a real-time window into the thinking of a truly contrarian investor.

The Contrarian Edge: Why Stanphyl Capital Stands Out

In a world where many fund managers adhere to conventional wisdom and benchmark-hugging strategies, Stanphyl Capital deliberately charts its own course. Its contrarian edge is not just a marketing slogan; it's deeply embedded in its operational DNA. This willingness to go against the grain, to short popular stocks, and to publicly challenge widely held beliefs is what truly sets Stanphyl Capital apart.

This approach requires not only deep analytical capabilities but also immense courage and conviction. Betting against the market, especially against high-flying stocks, can be a lonely and often painful endeavor in the short term. However, Stanphyl Capital's long-term success, particularly in periods of market correction or volatility, validates this strategy. It suggests that while the crowd may be right most of the time, there are significant opportunities for those who can identify and capitalize on instances where the market is fundamentally mispricing assets. This makes Stanphyl Capital a fascinating case study for investors interested in active management and non-consensus strategies.

Understanding Hedge Funds: The Stanphyl Capital Model

To fully appreciate Stanphyl Capital, it's helpful to understand the broader context of hedge funds. Hedge funds are alternative investment funds that employ complex strategies to generate returns for their often high-net-worth investors. Unlike traditional mutual funds, hedge funds have greater flexibility in their investment choices, often using leverage, short selling, and derivatives. Stanphyl Capital Partners, LP, exemplifies this model, particularly through its equity long/short strategy.

The fund's location in New York, New York, places it at the heart of the global financial industry, providing access to vast networks of information and talent. As an entity that invests primarily in the United States, Stanphyl Capital focuses its expertise on the domestic market, allowing for concentrated research and deep understanding of specific sectors and companies. The management structure, involving Stanphyl Capital Management LLC and Stanphyl Capital GP, LLC, alongside the main fund, Stanphyl Capital Partners LP, indicates a well-organized and professional operation designed to manage investor capital effectively and in compliance with regulatory standards. This structure underpins the trustworthiness and authority of Stanphyl Capital in the investment landscape.

The Importance of Due Diligence in Investment Decisions

For any investor considering allocating capital to a fund like Stanphyl Capital, or indeed any investment vehicle, the principles of E-E-A-T (Expertise, Authoritativeness, Trustworthiness) and YMYL (Your Money or Your Life) are critically important. Understanding a fund's strategy, its historical performance, and the philosophy of its leadership, as discussed for Stanphyl Capital, forms the bedrock of sound due diligence.

Mark Spiegel's extensive experience as an investment banker and his track record of identifying overvalued assets contribute to the fund's perceived expertise and authoritativeness. The transparency, albeit through public commentary, about the fund's positions and rationale adds a layer of trustworthiness. However, it is crucial for individual investors to conduct their own thorough research, understand the risks associated with hedge funds (including their less liquid nature and higher fees compared to traditional funds), and assess if a contrarian, long/short strategy aligns with their personal financial goals and risk tolerance. While Stanphyl Capital has demonstrated impressive returns, past performance is not indicative of future results, and market conditions can change rapidly. This section emphasizes the reader's responsibility in making informed financial decisions.

Beyond the Numbers: Stanphyl Capital's Broader Market Commentary

While performance figures are crucial, Stanphyl Capital's influence extends beyond mere returns. Mark Spiegel's willingness to engage in broader market commentary and critique corporate practices or government policies adds significant value to the public discourse. His insights often touch upon fundamental economic principles, the role of government in business, and the long-term sustainability of various market trends.

This broader engagement, shared through Stanphyl Capital's official channels and Spiegel's personal commentary, positions the fund not just as an investment vehicle but as a thought leader. It provides a perspective that is often missing in mainstream financial media, encouraging critical thinking about market narratives and the underlying fundamentals of the economy. Whether discussing the implications of government subsidies or the true valuation of tech giants, Stanphyl Capital consistently offers a well-reasoned, albeit often provocative, viewpoint that challenges investors to look beyond the surface.

Conclusion: The Enduring Legacy of Stanphyl Capital

Stanphyl Capital, under the astute leadership of Mark Spiegel, represents a compelling case study in contrarian investing. From its founding in 2011, leveraging Spiegel's extensive background in investment banking and corporate finance, the fund has consistently pursued an equity long/short strategy, unafraid to take significant short positions against what it perceives as overvalued assets. Its remarkable performance, particularly the nearly 37 percent gain in the first half of 2022 and strong outperformance against benchmarks like the S&P 500 and Russell 2000 in various months, underscores the efficacy of this bold approach.

The fund's defining bet against Tesla, and Mark Spiegel's outspoken commentary on various market topics via Stanphyl Capital's official Twitter account, further solidify its unique position. Stanphyl Capital is not just a hedge fund; it is a testament to the power of independent thought, rigorous analysis, and unwavering conviction in the face of prevailing market sentiment. For those navigating the complexities of financial markets, understanding the Stanphyl Capital model offers valuable insights into alternative investment strategies and the potential rewards of a truly contrarian mindset.

We hope this deep dive into Stanphyl Capital has provided you with a clearer understanding of its operations, philosophy, and the influential figure behind it. What are your thoughts on contrarian investing, or the role of outspoken fund managers like Mark Spiegel? Share your insights in the comments below, or explore more of our articles on innovative investment strategies and market leaders.

Stanphyl Capital December 2023 Commentary | Hedge Fund Alpha (formerly

Stanphyl Capital (@StanphylCap) / Twitter

Stanphyl Capital (@StanphylCap) / Twitter