Unlocking Financial Freedom: A Deep Dive Into The Dave App

In today's digital age, many people turn to search engines for answers to a myriad of questions, from personal curiosities like "Dave Rivenbark wife" to practical financial solutions. While the former might lead to a dead end without specific public information, the latter often points to innovative platforms designed to simplify our lives. One such platform, frequently searched and widely used, is Dave – not a person, but a groundbreaking financial app that's reshaping how millions of Americans manage their money. This article will delve deep into the Dave app, exploring its features, benefits, and how it aims to level the financial playing field for everyday individuals.

The Dave app has emerged as a significant player in the fintech landscape, driven by a mission to provide accessible and affordable financial services. It addresses common pain points associated with traditional banking, such as high fees, overdraft charges, and limited access to quick funds. By offering a suite of services from cash advances to checking accounts, Dave empowers users with tools to navigate their financial lives with greater ease and confidence, directly from their mobile devices.

Table of Contents:

- Understanding the Dave App: Its Mission and Purpose

- ExtraCash™ Advances: Your Safety Net Without the Strings

- The Dave Checking Account: A New Era of Banking

- Earning and Saving with Dave: Beyond the Basics

- Securing Your Financial Future with Dave

- Getting Started with Dave: A Seamless Onboarding Experience

- Managing Your Dave Account with Ease

- Dave is Not a Bank: Understanding Its Structure

Understanding the Dave App: Its Mission and Purpose

Millions of people use Dave, a mobile banking app designed to provide financial relief and opportunities for everyday Americans. At its core, Dave is on a mission to level the financial playing field, offering services that traditional banks often overlook or make inaccessible due to stringent requirements or prohibitive fees. Unlike the personal query of "Dave Rivenbark wife," which might seek biographical details, the Dave app focuses squarely on financial empowerment. It acts as a financial partner, helping users avoid overdrafts, find side hustles, and access funds when they need them most. Its user-friendly interface and commitment to transparency have made it a go-to solution for those seeking more control over their finances. The app's growing popularity underscores a significant shift in consumer preference towards digital-first financial solutions that prioritize convenience, affordability, and accessibility.ExtraCash™ Advances: Your Safety Net Without the Strings

One of the most compelling features of the Dave app is its ExtraCash™ advances. This service is a game-changer for individuals who occasionally face unexpected expenses or need a little extra cash to bridge the gap between paychecks. With ExtraCash™ from Dave, you can get advances up to $500, a lifeline that can prevent costly overdraft fees or reliance on high-interest payday loans. This feature directly addresses the immediate financial needs of users, offering a quick and reliable solution.No Credit Check, No Interest, No Late Fees

What truly sets ExtraCash™ apart is its commitment to fairness and accessibility. Unlike many traditional lending options, Dave's ExtraCash™ advances come with no credit check, no interest, and no late fees. This model is revolutionary, as it removes significant barriers that often prevent people from accessing short-term funds. The absence of a credit check means that even those with less-than-perfect credit scores can qualify, ensuring that financial assistance is available to a broader demographic. The elimination of interest and late fees means users don't get trapped in a cycle of debt, a common pitfall with other quick-cash solutions. To see how much ExtraCash™ you qualify for with no credit check, you just download the Dave app, link your bank account, and open an ExtraCash™ account to see if you’re eligible. This transparent and user-friendly process embodies Dave's mission to provide equitable financial services.The Dave Checking Account: A New Era of Banking

Beyond cash advances, the Dave app also offers a full-fledged checking account designed with the modern consumer in mind. Opening a Dave checking account in the app provides users with access to a suite of benefits that simplify everyday banking and help them save money. This account is built on the premise of reducing the financial burden often imposed by traditional banks, making it an attractive option for millions looking for a better banking experience.Say Goodbye to Common Banking Fees

A significant advantage of the Dave checking account is its fee structure—or lack thereof. Users don’t have to worry about keeping a certain amount of money in their Dave checking account, as there are no minimum balance requirements. More importantly, the account comes with no overdraft, minimum balance, or late fees. This is a stark contrast to many traditional banks that often charge hefty fees for these occurrences, which can quickly erode a person's savings. With Dave, users can fund it their way, on their own time, without the constant stress of hidden charges. Furthermore, for convenient cash access, there are no ATM fees at 40k+ MoneyPass ATMs, providing widespread access to cash without incurring additional costs. This commitment to fewer fees is central to Dave's mission of leveling the financial playing field.Earning and Saving with Dave: Beyond the Basics

The Dave app isn't just about managing existing funds; it also provides avenues for users to earn more and optimize their financial flow. This holistic approach to financial wellness distinguishes Dave from many other banking apps, making it a comprehensive tool for financial growth.Early Pay and Cash Back Rewards

One of the innovative features tied to the Dave checking account is Early Pay. This allows users to get access to their paychecks up to two days early, which can be incredibly beneficial for budgeting and managing bills, especially when timing is crucial. This early access to funds can alleviate financial stress and help users avoid late payments or the need for short-term loans. Additionally, the Dave debit card, issued under a license from Mastercard®, often comes with cash back opportunities, allowing users to earn rewards on their everyday spending. These small but consistent savings can add up over time, contributing to a healthier financial picture.Finding Work When You Need It

Understanding that financial stability often requires more than just managing expenses, the Dave app goes a step further by helping users find work when they need it, right from the Dave app. This unique feature connects users with opportunities for side hustles, enabling them to boost their income directly through the platform. Whether it's picking up extra shifts or finding gig work, Dave acts as a bridge to additional earning potential. This proactive approach to income generation truly embodies Dave's commitment to empowering everyday Americans, moving beyond just providing financial services to actively facilitating financial growth.Securing Your Financial Future with Dave

In the digital age, the security of financial accounts is paramount. Users often ask, "How can I make sure my Dave account is secure?" and "How can I protect my Dave account?" Dave understands these concerns and employs robust measures to safeguard user information and funds. While this article doesn't delve into personal details like "Dave Rivenbark wife," it prioritizes the financial security of its users.How Dave Protects Your Account

Dave implements industry-standard security protocols to protect user data and prevent unauthorized access. This includes encryption for data in transit and at rest, multi-factor authentication, and continuous monitoring for suspicious activity. Identifying a potential account takeover is crucial, and Dave has systems in place to detect unusual patterns or login attempts. Users are also encouraged to take proactive steps, such as using strong, unique passwords, enabling biometric authentication (if available), and being wary of phishing attempts. The app provides guidance on how to update personal information on your Dave account securely and how to report any suspicious activity promptly. The partnership with Evolve Bank & Trust, Member FDIC, also ensures that deposit accounts are FDIC insured, providing an additional layer of security for user funds.Getting Started with Dave: A Seamless Onboarding Experience

For those looking to embrace a new way of managing their finances, getting started with Dave is remarkably straightforward. The process is designed to be quick and user-friendly, ensuring that anyone can access its benefits without unnecessary hurdles. To get started with Dave, you simply download the latest version of the Dave app. It's readily available on major app stores: you can download on the App Store for iOS devices or get it on Google Play for Android. Once the app is installed, the intuitive interface guides you through the sign-up process. The app will prompt you to open a Dave checking account, which then grants you immediate access to early pay, cash back, and ExtraCash™ advances. The verification process is typically quick, though sometimes users might ask, "Why can’t you verify my identity?" This usually happens due to minor discrepancies in information or security checks, which can often be resolved by contacting Dave's support. It's important to note that Dave accounts are personal, and the question "Can I share my Dave account with someone else?" is generally met with a no, as accounts are tied to individual identities for security and compliance reasons.Managing Your Dave Account with Ease

Once set up, managing your Dave account is designed to be as effortless as possible. The app serves as a comprehensive hub for all your financial activities within Dave. From checking your balance to initiating transactions, everything is accessible at your fingertips. About your accounts at Dave, the app provides clear summaries and detailed transaction histories, allowing users to stay informed about their spending and deposits. If you need to update your personal information on your Dave account, the app offers a straightforward path to do so securely. Taking ExtraCash™ is also a simple process, initiated directly within the app once you qualify. Regular updates to the Dave app to the latest version ensure that users always have access to the newest features, security enhancements, and performance improvements, contributing to a smooth and reliable user experience. The emphasis on user control and intuitive design ensures that managing your finances with Dave is not a chore but a convenient part of your daily routine.Dave is Not a Bank: Understanding Its Structure

It's crucial for users to understand that Dave is not a bank in the traditional sense. This distinction is important for transparency and regulatory compliance. While Dave offers banking services, it operates as a financial technology company that partners with regulated financial institutions. Specifically, Evolve Bank & Trust, Member FDIC, or another partner bank provides deposit accounts and issues the Dave debit card under a license from Mastercard®. This partnership structure ensures that user funds held in Dave checking accounts are FDIC insured, offering the same level of protection as traditional bank accounts. This collaborative model allows Dave to focus on developing innovative app features and a user-centric experience, while its partner banks handle the underlying banking infrastructure and regulatory compliance. This unique setup allows Dave to deliver on its mission to provide accessible financial services without the overhead of being a full-fledged bank, ultimately benefiting the end-user with fewer fees and more flexible options.In conclusion, while a search for "Dave Rivenbark wife" might lead to personal inquiries, the "Dave" that millions rely on is a powerful financial app dedicated to empowering everyday Americans. From its revolutionary ExtraCash™ advances with no interest or credit checks to its fee-free checking accounts and opportunities for side hustles, Dave is truly leveling the financial playing field. By offering accessible, secure, and user-friendly financial tools, Dave helps individuals navigate their money with greater confidence and less stress. If you're looking for a modern solution to manage your finances, avoid common banking fees, and gain more control over your cash flow, exploring the Dave app could be your next smart financial move. Download the Dave app today on the App Store or Google Play to discover how it can transform your financial journey.

Ashley Rivenbark's Instagram, Twitter & Facebook on IDCrawl

Kaylee Carlson and David Rivenbark's Wedding Website

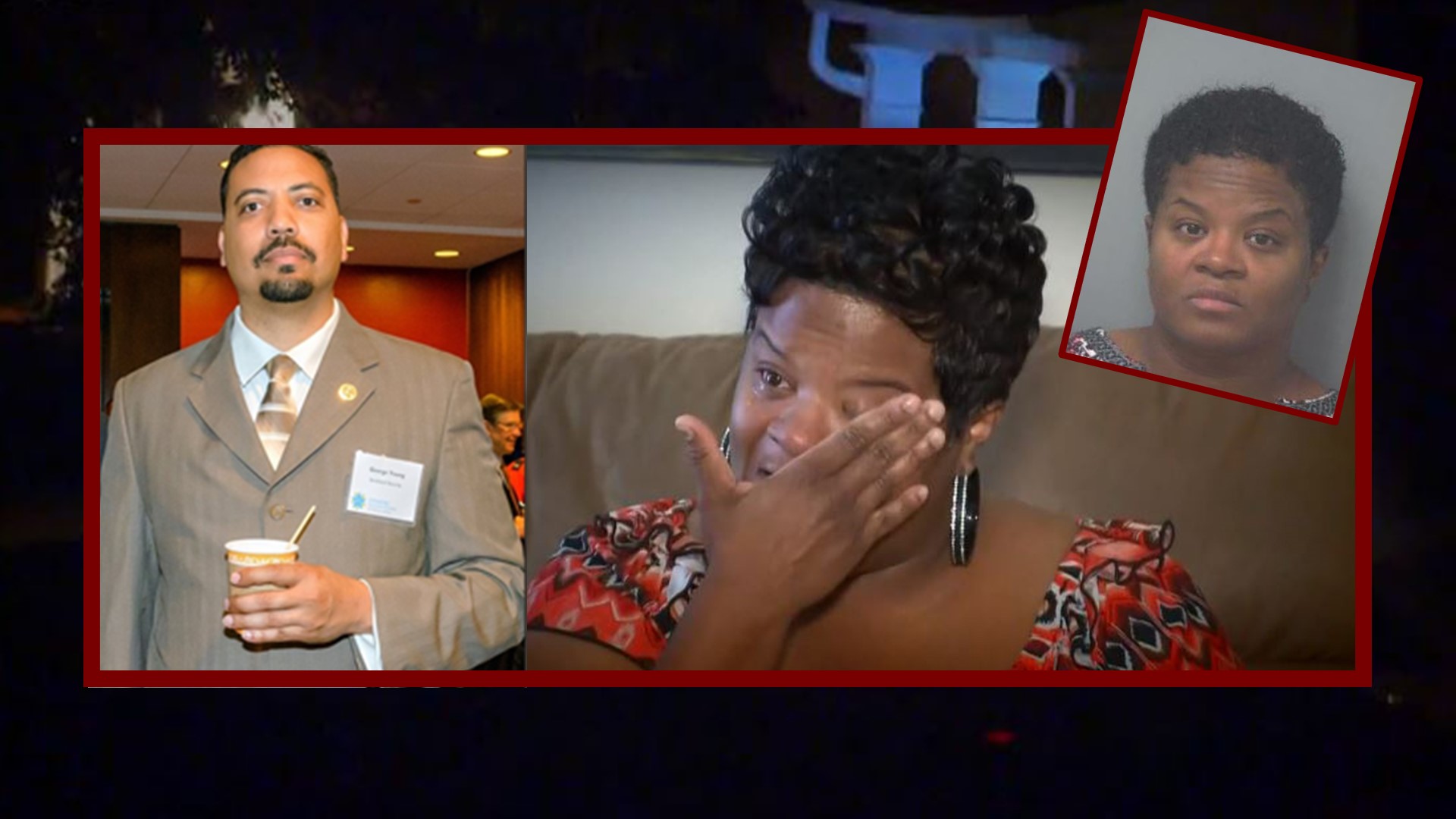

Wife who cried on camera begins trial for husband's murder | 11alive.com