The CoreLogic Rental Property Solutions Freeze: Navigating Uncharted Waters

The rental property market is a dynamic landscape, constantly shifting with economic trends, demographic changes, and technological advancements. For landlords, property managers, and real estate investors, staying ahead requires robust data and reliable insights. However, what happens when a critical data pipeline experiences a significant disruption, such as a "freeze" in key solutions? The concept of a CoreLogic Rental Property Solutions Freeze brings to light the vulnerabilities within an industry heavily reliant on precise, up-to-the-minute information. This article delves into the potential implications of such an event and how CoreLogic's broader suite of services can empower stakeholders to not only weather the storm but also thrive amidst uncertainty.

In an environment where every decision, from setting rent prices to assessing tenant risk, is informed by data, any impediment to information flow can have cascading effects. A "freeze" in rental property solutions isn't just a technical glitch; it represents a potential disruption to operational efficiency, strategic planning, and ultimately, profitability. Understanding the nature of such a challenge and leveraging comprehensive resources becomes paramount for anyone operating within the vast and complex rental housing ecosystem. This exploration aims to shed light on how industry professionals can maintain resilience and make informed choices, even when faced with unexpected data challenges.

Table of Contents

- Understanding the CoreLogic Rental Property Solutions Freeze

- CoreLogic: A Pillar in Property Information and Analytics

- The Critical Role of Comprehensive Property Data

- Navigating Rental Market Volatility with CoreLogic Insights

- Beyond Rental Data: CoreLogic's Diverse Solutions for Property Management

- Empowering Mortgage and Home Equity Portfolios

- Strategies for Adapting to a "Freeze" and Ensuring Business Continuity

- The Future of Rental Property Solutions and CoreLogic's Vision

Understanding the CoreLogic Rental Property Solutions Freeze

The term "freeze" in the context of rental property solutions from a leading provider like CoreLogic can evoke various interpretations. It might suggest a temporary halt in data updates, a re-evaluation of certain service offerings, or perhaps a strategic shift in how specific rental property data is delivered or accessed. While the exact nature of such a "freeze" would dictate its specific impact, the general implication is a period of reduced or altered access to crucial information that property professionals rely on daily. This could affect everything from tenant screening and rent analysis to market trend forecasting and property valuation. For instance, if a component of CoreLogic's rental property solutions were to experience a freeze, it could mean that real-time vacancy rates, average rental prices by neighborhood, or detailed property characteristics for rental units might become temporarily unavailable or outdated. This scenario poses significant challenges for decision-makers. Imagine a property manager trying to set a competitive rent for a new listing without up-to-the-minute comparable data, or an investor attempting to assess the viability of a new acquisition without reliable insights into local rental demand. Such a disruption underscores the critical dependency the industry has on robust, continuous data streams. It forces a re-evaluation of backup strategies and highlights the importance of partnering with providers who offer comprehensive, resilient data ecosystems.CoreLogic: A Pillar in Property Information and Analytics

Before diving deeper into navigating a potential CoreLogic Rental Property Solutions Freeze, it's essential to understand the immense scope and influence of CoreLogic itself. CoreLogic is not merely a data provider; it's an Irvine, CA-based leading information services provider of financial, property, and consumer information, analytics, and business intelligence. Their mission is clear: "We transform complex relationships into ideas that expand your potential and reveal better outcomes." This commitment to clarity and actionable intelligence is what makes their services indispensable to countless professionals. They are designed to empower people with answers, providing comprehensive property data at the click of a button.A Legacy of Data Excellence

CoreLogic's foundation is built on an unparalleled depth of data. From detailed property characteristics and ownership records to sales histories and mortgage information, their databases are vast and meticulously maintained. This comprehensive approach allows them to offer insights that go far beyond surface-level observations. For instance, their ability to provide insights into your mortgage and home equity portfolios with integrated property, recordation, and credit data through advanced analytics and monitoring capabilities demonstrates their holistic view of the property lifecycle. This integrated data approach is crucial for understanding the true value and potential of real estate assets, whether for rental purposes or broader investment strategies. Their expertise spans various sectors, making them a go-to source for reliable, actionable intelligence.Global Reach and Local Impact

While rooted in California, CoreLogic's influence extends globally. CoreLogic is the leading property data, information, analytics and services provider in Australia and New Zealand with growing partnerships throughout Asia. This international footprint highlights their capability to adapt to diverse market conditions and regulatory environments, offering localized expertise backed by global resources. For property professionals, this means access to best practices and data methodologies that are refined across multiple markets, enhancing the robustness of their solutions. Even if a CoreLogic Rental Property Solutions Freeze were to occur in one region, their global presence suggests a resilience and capacity for rapid adaptation or alternative data sourcing, emphasizing their commitment to continuous service.The Critical Role of Comprehensive Property Data

The backbone of any successful real estate venture, especially in the rental sector, is data. CoreLogic prides itself on delivering comprehensive property data at the click of a button, making it accessible and actionable for professionals. This isn't just about raw numbers; it's about the intelligence derived from those numbers. In a market where decisions often involve significant financial commitments, the quality and breadth of data can be the difference between success and costly mistakes. CoreLogic's strength lies in its ability to synthesize vast amounts of information into digestible, insightful formats. As they state, "Cotality empowers people with answers." This philosophy is critical when navigating complex scenarios, such as understanding local market dynamics, assessing tenant risk, or evaluating investment opportunities. For instance, detailed data on property ownership, historical rents, and neighborhood demographics allows landlords to pinpoint optimal rental rates, identify high-demand areas, and tailor their marketing efforts effectively. Without this comprehensive view, property management becomes a series of educated guesses rather than strategic decisions. Moreover, the ability to transform complex relationships into ideas that expand your potential and reveal better outcomes is what truly sets advanced data providers apart. This means not just presenting data, but providing the analytical tools and intelligence to interpret it, helping users uncover hidden opportunities or mitigate potential risks. In the face of a CoreLogic Rental Property Solutions Freeze, the existing knowledge base and strategic insights gained from previous data access would become even more valuable, guiding decisions during a period of limited real-time updates. It underscores the importance of not just accessing data, but truly understanding and integrating it into one's operational framework.Navigating Rental Market Volatility with CoreLogic Insights

The rental market is inherently volatile, influenced by economic cycles, interest rate fluctuations, and population shifts. A CoreLogic Rental Property Solutions Freeze, whether temporary or indicative of a service evolution, would undoubtedly add another layer of complexity. However, CoreLogic's broader analytical capabilities offer a robust framework for navigating such volatility. The impact of disruption on landlords and investors can be significant. Without continuous data on rental trends, vacancy rates, and tenant demographics, property owners might misprice their units, leading to prolonged vacancies or under-optimized revenue. Investors might misjudge market demand, leading to poor acquisition decisions. This is where the strategic application of historical data and broader market intelligence becomes crucial. CoreLogic's extensive historical datasets allow professionals to identify long-term trends and patterns, providing a valuable context even when real-time updates are constrained. Leveraging analytics for strategic decisions means going beyond just current numbers. It involves predictive modeling, risk assessment, and scenario planning. CoreLogic's advanced analytics tools enable users to forecast potential market shifts, evaluate the impact of various economic factors on rental demand, and assess the financial viability of properties under different conditions. For example, understanding the correlation between local employment rates and rental affordability, or the impact of new housing developments on existing rental stock, allows for more informed and resilient strategies. Even during a CoreLogic Rental Property Solutions Freeze, the analytical frameworks and historical insights previously gleaned from their platforms would remain invaluable, guiding strategic adjustments and contingency planning.Beyond Rental Data: CoreLogic's Diverse Solutions for Property Management

While the focus here is on a potential CoreLogic Rental Property Solutions Freeze, it's vital to recognize that CoreLogic offers a vast ecosystem of data and services that extend far beyond just rental-specific insights. These diverse solutions provide additional layers of protection, efficiency, and intelligence that are critical for holistic property management, especially when core rental data might be temporarily affected.Protecting Assets with Trusted Weather Verification

One often-overlooked aspect of property management is risk mitigation, particularly concerning natural disasters. CoreLogic offers trusted weather verification solutions, including hail and wind verification reports, hail and wind monitor, hail alert notification, hail size maps, and lightning reports. For landlords and property managers, this means having precise, verifiable data on weather events that could impact their properties. This information is invaluable for insurance claims, maintenance scheduling, and proactive risk assessment. Knowing exactly when and where a severe weather event occurred, and its intensity, can streamline the claims process, prevent fraud, and ensure properties are repaired promptly, minimizing downtime and protecting rental income. This proactive approach to property protection becomes even more critical when other operational data, like rental market trends, might be in a state of flux due to a CoreLogic Rental Property Solutions Freeze.Streamlining Financial Management with Digital Tax Tools

Efficient financial management is another cornerstone of successful property operations. CoreLogic addresses this with its digital tax portal. Access property tax information and digital tools through the CoreLogic Digital Tax Portal for efficient tax management. This solution simplifies the often-complex process of managing property taxes, ensuring compliance and optimizing financial outflows. From tracking assessment values to managing payments and identifying potential discrepancies, these tools save time and reduce the risk of errors. In a scenario where a CoreLogic Rental Property Solutions Freeze might create uncertainty in revenue forecasting, having robust tax management tools ensures that at least one critical financial aspect remains stable and well-managed, contributing to overall business resilience.Empowering Mortgage and Home Equity Portfolios

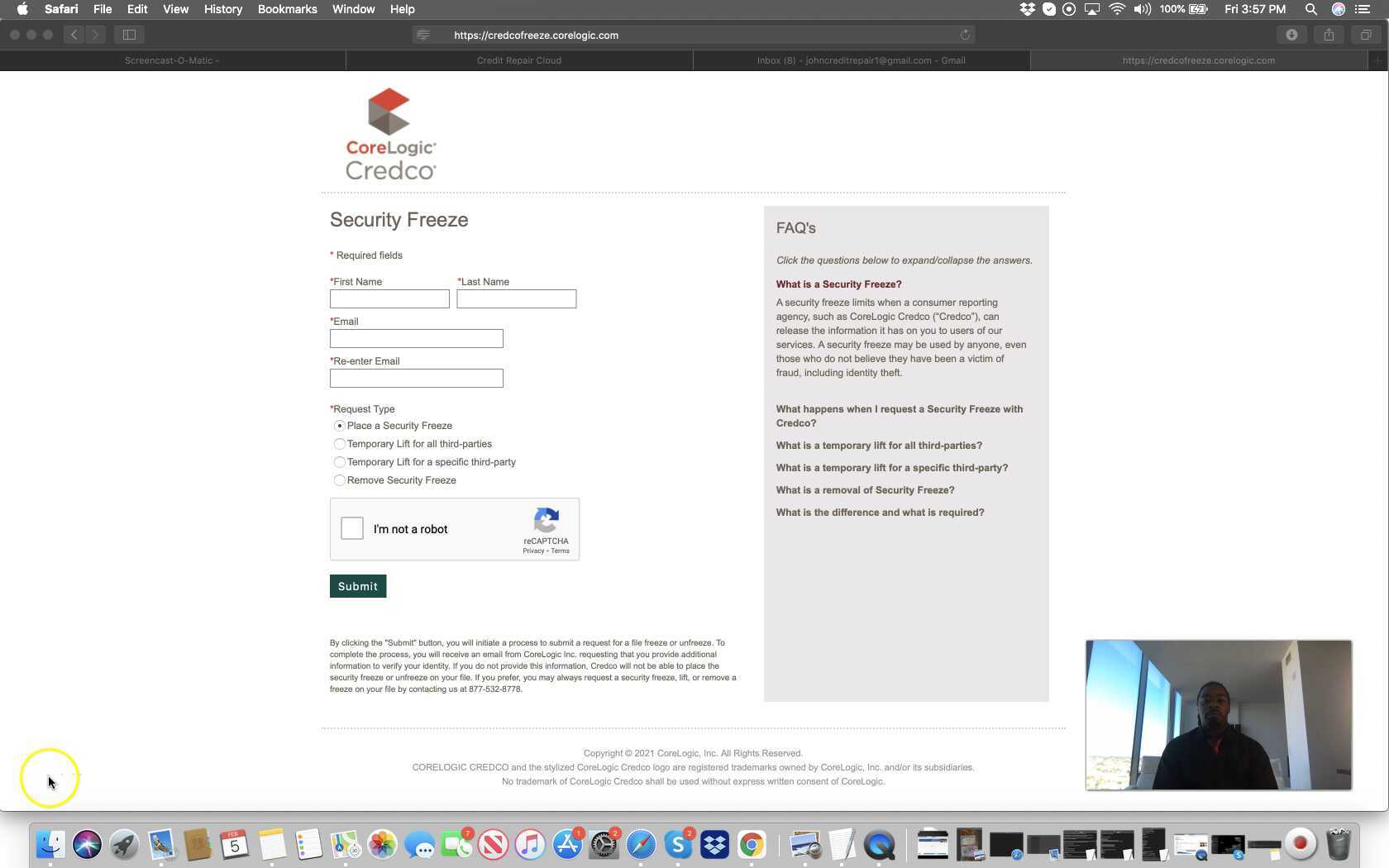

Beyond the immediate rental market, CoreLogic's influence extends deeply into the broader financial ecosystem of real estate. Their capabilities in mortgage and home equity data are particularly noteworthy, providing a comprehensive view that can indirectly impact the rental market by influencing investment decisions and property liquidity. CoreLogic provides insights into your mortgage and home equity portfolios with integrated property, recordation, and credit data through advanced analytics and monitoring capabilities. This means lenders, investors, and financial institutions can gain a holistic understanding of their loan portfolios, assessing risk, identifying opportunities, and ensuring compliance. For property investors, understanding the mortgage landscape is crucial, as it affects financing costs, property acquisition strategies, and the overall health of the housing market, which in turn impacts rental demand and supply. A robust mortgage market can stimulate investment in rental properties, while a constrained one can slow it down. Furthermore, CoreLogic is a leading provider of comprehensive digital mortgage workflows, uniquely positioned to help clients navigate the complexities of loan origination. This streamlines the process from application to closing, enhancing efficiency and reducing errors. For anyone involved in real estate, including those focused on rentals, understanding these underlying financial mechanisms is key. Even if a CoreLogic Rental Property Solutions Freeze were to occur, the stability and efficiency of the mortgage market, facilitated by CoreLogic's broader tools, would still provide a critical foundation for real estate investment and development. Their extensive credit services, exemplified by "CoreLogic Credco Automotive and Specialty Credit Service General Number Phone," also highlight their role in providing comprehensive credit data, which is essential for tenant screening and financial risk assessment across various sectors, including rental.Strategies for Adapting to a "Freeze" and Ensuring Business Continuity

The prospect of a CoreLogic Rental Property Solutions Freeze, while hypothetical, serves as a powerful reminder of the need for robust contingency planning in data-dependent industries. Property professionals cannot afford to be caught off guard. Building resilience into operations requires a multi-faceted approach. Proactive data utilization is key. This means not just consuming data, but actively analyzing it, identifying trends, and integrating insights into long-term strategies. Regularly downloading and archiving critical market reports, historical rent data, and property insights from CoreLogic's platforms when they are fully operational can create a valuable internal knowledge base. This stored data can serve as a crucial reference point during any period of reduced real-time access. Furthermore, investing in internal analytical capabilities and training staff to interpret data independently can reduce reliance on external, real-time feeds for every decision. Building resilience in your operations also involves diversifying your information sources where possible. While CoreLogic is a dominant player, cross-referencing information with local real estate associations, government housing reports, and regional market analyses can provide a broader perspective. Establishing strong relationships with local real estate agents and brokers who have their finger on the pulse of the market can also offer anecdotal, yet valuable, insights that complement quantitative data. Implementing robust property management software that can store and analyze your own portfolio's historical performance data (e.g., vacancy rates, maintenance costs, tenant turnover) is another critical step. This internal data becomes a powerful tool for decision-making, even if external market data faces a temporary CoreLogic Rental Property Solutions Freeze. Ultimately, the goal is to create a resilient operational framework that can adapt and continue making informed decisions, regardless of external data disruptions.The Future of Rental Property Solutions and CoreLogic's Vision

The rental property market is in a constant state of evolution, driven by technological advancements, changing demographics, and evolving economic landscapes. Any "freeze" in solutions, while potentially disruptive, can also be a catalyst for innovation and re-evaluation, both for users and providers like CoreLogic. CoreLogic's commitment to innovation is evident in its continuous development of advanced analytics and digital workflows. They are not static; they are constantly refining their offerings to meet the dynamic needs of the market. This includes leveraging artificial intelligence, machine learning, and big data to provide even more predictive and prescriptive insights. The future of rental property solutions will likely see greater integration of various data points – from hyper-local market conditions and demographic shifts to climate risk and economic indicators – to provide a truly holistic view for property professionals. CoreLogic's vision aligns with empowering users through accessible, actionable data. Their invitation to "Get started with a free account" for certain services or trials demonstrates their commitment to broad accessibility and user engagement. Furthermore, the standard practice of requiring users to "Please enter your credentials to login to your account" ensures data security and personalized access to their comprehensive suite of tools. This emphasis on secure, tailored access underscores their dedication to providing reliable and trustworthy solutions. Even if a CoreLogic Rental Property Solutions Freeze were to occur, it would likely be a temporary measure aimed at enhancing future service delivery or integrating new, more robust features, ultimately leading to even more powerful tools for the rental property sector. The goal remains to equip professionals with the insights needed to navigate complexities and achieve better outcomes in an ever-changing market.Conclusion

The hypothetical CoreLogic Rental Property Solutions Freeze serves as a potent reminder of the critical role that comprehensive, reliable data plays in the rental property industry. While such a disruption could pose significant challenges, it also highlights the resilience and adaptability required of landlords, property managers, and investors. CoreLogic, with its vast array of property, financial, and consumer data, advanced analytics, and global reach, remains a foundational resource for navigating market complexities. From detailed property insights and mortgage portfolio analysis to critical weather verification and efficient tax management tools, their ecosystem of solutions provides a robust framework for informed decision-making. In an increasingly data-driven world, the ability to access, interpret, and act upon insights is paramount. Even in the face of a "freeze" or other market disruptions, leveraging CoreLogic's broader offerings and building internal data resilience can ensure business continuity and strategic advantage. The future of rental property solutions will undoubtedly be shaped by continuous innovation, and CoreLogic's ongoing commitment to transforming complex relationships into ideas that expand potential will remain at the forefront. As the market evolves, staying informed and prepared is not just an advantage, but a necessity. We encourage you to explore the comprehensive data and analytical tools available through CoreLogic to empower your property ventures. What are your thoughts on data reliance in the rental market? Share your insights in the comments below, or consider exploring other articles on our site for more expert perspectives on real estate trends and solutions.Copyright 2024 © CoreLogic, Inc.

CoreLogic Website Security Freeze

Property Solutions | CoreLogic®

CoreLogic Reports 34,000 Completed Foreclosures in July 2016