Navigating Overnight Market Shifts: Understanding Night Correction Tradelt

In the fast-paced world of global finance, where markets never truly sleep, understanding the nuances of price movements that occur outside regular trading hours is paramount. One such critical phenomenon that astute traders and investors must grapple with is what we term "night correction tradelt." This concept refers to significant market adjustments or price corrections that unfold during the periods when major exchanges are typically closed, yet underlying forces continue to shape asset valuations. Ignoring these overnight shifts can lead to unexpected portfolio impacts, while recognizing and preparing for them can unlock strategic advantages.

The global financial landscape is a tapestry woven with interconnected markets, each operating on its own schedule but constantly influencing one another. While most retail investors focus on the traditional "day" trading hours of their local exchanges, the reality is that news breaks, economic data is released, and geopolitical events unfold around the clock. These factors often trigger immediate reactions in 24/7 markets like forex and cryptocurrencies, or set the stage for dramatic opening gaps in equity markets the following morning. Delving into the mechanics of night correction tradelt is not just an academic exercise; it's a vital component of robust risk management and proactive investment strategy in today's always-on financial ecosystem.

Table of Contents

- Understanding the "Night" in Trading: Beyond Just Sleep

- What Exactly is Night Correction Tradelt? Defining the Phenomenon

- Key Drivers of Night Correction Tradelt: Why Markets Shift Overnight

- Impact on Different Asset Classes: Stocks, Forex, Crypto, and Commodities

- Strategies for Managing Night Correction Tradelt Risks

- Leveraging Night Correction Tradelt: Opportunities for Astute Traders

- The Psychological Toll: Navigating Overnight Volatility

- Future Trends: Adapting to an Ever-Connected Global Market

Understanding the "Night" in Trading: Beyond Just Sleep

When someone mentions "night," our minds typically conjure images of rest, quiet, and perhaps the hours between 8 PM and 6 AM, or thereabouts. Socially, we might wish someone "Good night" as a farewell, implying a peaceful sleep. However, in the context of financial markets, the "night" takes on a far more dynamic and complex meaning. It's not merely a period of inactivity but often a crucible where significant price adjustments, or a "night correction tradelt," can silently brew or violently erupt. Consider the common understanding of time: "Evening lasts from after afternoon (4 p.m.) till after sunset, depending on where you are." Even if you are meeting a person at 10 p.m., at night, the first time of the day, you can still greet him/her with "good morning" in some contexts, signifying a new beginning. This fluidity of time perception, where "night" can transition into "morning" even before dawn, mirrors the continuous, interconnected nature of global markets. While one major exchange might close its doors, another across the globe is just waking up, ready to react to the latest news or economic data. The relevance of that is whether someone else's time is ahead or behind yours, and it is not necessarily a business meeting that dictates market movements. The market's "night" is thus less about a fixed block of hours and more about the period when your primary market is closed, yet global events continue to ripple through the financial system. It's a time when underlying sentiment can shift dramatically, setting the stage for the next trading session.What Exactly is Night Correction Tradelt? Defining the Phenomenon

At its core, a "correction" in financial markets refers to a significant decline in the price of a security, asset, or market, typically defined as a drop of 10% or more from its recent peak. When we add "night" to this, "night correction tradelt" specifically points to these substantial price adjustments that occur or become evident during the off-hours of a particular market. This is not merely routine price fluctuation; it implies a meaningful re-evaluation of asset values, often triggered by external factors that emerge when most traders are offline. This phenomenon is distinct from a general market downturn. A night correction tradelt often manifests as a "gap" at the market open, where the opening price is significantly different from the previous day's closing price, reflecting the overnight re-pricing. For instance, if a major stock market closes, but an unexpected geopolitical event occurs or a key economic report is released during those off-hours, the collective sentiment and valuation of assets can shift dramatically. By the time the market reopens, the pent-up demand or supply will cause prices to gap up or down, effectively executing an overnight correction. This concept is vital for traders who hold positions overnight, as it represents a significant, often unhedged, risk or opportunity that materializes outside of their active trading window. It underscores the fact that market forces are constantly at play, independent of specific trading hours or individual meal and bedtime schedules.Key Drivers of Night Correction Tradelt: Why Markets Shift Overnight

The forces behind a night correction tradelt are diverse and often global in nature. Understanding these drivers is crucial for anticipating potential overnight shifts and protecting one's portfolio.Global Interconnectedness and Time Zones

The world's financial markets are inextricably linked. What happens in Tokyo or London during your local night can profoundly impact New York's open. Economic data releases (e.g., inflation reports, unemployment figures), central bank announcements, and corporate earnings calls often occur outside of specific market hours. For example, a tech giant might release disappointing earnings after the U.S. market closes, triggering a sharp sell-off in its stock during after-hours trading and potentially leading to a significant gap down at the next day's open – a classic night correction tradelt. The relevance of that is whether someone else's time is ahead or behind yours, creating a continuous chain reaction across different time zones. This interconnectedness means that even when your local market is "asleep," global events are actively shaping the landscape. Other significant drivers include:- Geopolitical Events: Wars, political instability, trade disputes, or major diplomatic shifts can send shockwaves through markets regardless of the time of day. News of a conflict escalating overnight can cause oil prices to surge or safe-haven assets like gold to rally.

- Natural Disasters: Earthquakes, tsunamis, or other catastrophic events in key economic regions can disrupt supply chains, damage infrastructure, and trigger immediate market reactions.

- Sudden Policy Changes: Unexpected government policy announcements, regulatory changes, or judicial rulings can have immediate and dramatic effects on specific sectors or the broader market.

- Major Corporate News: Beyond earnings, significant mergers and acquisitions, leadership changes, or product recalls announced overnight can cause substantial price movements in individual stocks.

- Liquidity Gaps: Overnight markets, especially after-hours trading for equities, can have significantly lower liquidity than regular trading hours. This means that even relatively small orders can cause disproportionately large price swings, exacerbating corrections.

Impact on Different Asset Classes: Stocks, Forex, Crypto, and Commodities

The manifestation of a night correction tradelt varies significantly across different asset classes due to their unique trading mechanisms and underlying market structures. * Stocks: For equities, night corrections typically appear as opening gaps. If negative news breaks overnight, a stock might open significantly lower than its previous close, creating a "gap down." Conversely, positive news can lead to a "gap up." While some after-hours trading occurs, it's often illiquid, meaning the full force of the correction is usually felt at the next day's open. * Forex (Foreign Exchange): The forex market operates 24 hours a day, five days a week. This means that night corrections are less about "gaps" and more about continuous, sometimes rapid, price movements. Major economic data releases (e.g., U.S. Non-Farm Payrolls, European Central Bank interest rate decisions) often occur at specific times that might be "night" for traders in other regions, leading to immediate and volatile shifts in currency pairs. * Cryptocurrencies: The crypto market is truly 24/7, 365 days a year. Night corrections in this space are constant and can be triggered by a wide array of factors, from regulatory news in one country to major hacks or protocol upgrades. The high volatility and continuous trading mean that significant price adjustments can happen at any hour, making continuous monitoring essential for traders. * Commodities: Futures contracts for commodities like oil, gold, and agricultural products also trade extensively outside traditional stock market hours. Geopolitical tensions, supply disruptions, or changes in global demand can lead to substantial night corrections in these markets, which then influence related stocks (e.g., energy companies, mining firms) at their open. The ability to discern between a temporary overnight wobble and a genuine night correction tradelt that signals a more fundamental shift is a skill honed through experience and diligent market analysis.Strategies for Managing Night Correction Tradelt Risks

Given the potential for significant overnight price movements, managing the risks associated with night correction tradelt is paramount for any serious trader or investor.Pre-Market and After-Hours Trading Considerations

For stock traders, monitoring pre-market and after-hours trading sessions can provide early clues about potential overnight corrections. While liquidity might be lower, significant price movements in these sessions often foreshadow the direction of the opening bell. However, relying solely on these sessions for trading decisions can be risky due to the thin order books. Key risk management strategies include:- Position Sizing: Never allocate an overly large portion of your capital to a single trade, especially if you plan to hold it overnight. Smaller position sizes reduce the impact of adverse night corrections.

- Stop-Loss Orders: While not foolproof against large gaps, placing stop-loss orders can limit potential losses if a night correction tradelt occurs. However, be aware that in the event of a significant gap, your order might be filled at a price far worse than your specified stop.

- Hedging Strategies: For sophisticated traders, hedging can mitigate overnight risk. This might involve taking an opposing position in a related asset (e.g., shorting an index future if you have a long equity portfolio) or using options to protect against downside moves.

- Staying Informed: Proactively monitor global news, economic calendars, and company announcements, particularly during off-hours. Being aware of potential catalysts can help you anticipate and prepare for night corrections.

- Reducing Overnight Exposure: For highly volatile assets or during periods of high uncertainty, consider closing positions before market close to avoid overnight risk entirely. This is a common strategy for day traders.

- Diversification: A well-diversified portfolio is naturally more resilient to specific asset or sector-specific night corrections.

Leveraging Night Correction Tradelt: Opportunities for Astute Traders

While night corrections can pose risks, they also present unique opportunities for traders who are prepared and nimble. The adage "like night and day" can apply to market sentiment, where overnight shifts create stark contrasts between closing and opening prices, offering distinct trading setups.Identifying Gaps and Opening Swings

One of the most common ways to capitalize on night correction tradelt is through gap trading. A significant overnight correction creates a price "gap" between the previous day's close and the current day's open. Traders often develop strategies around these gaps:- Gap Fills: Some traders believe that gaps tend to "fill" or retrace back to the previous day's closing price. This strategy involves taking a position against the gap's direction, anticipating a reversal.

- Gap Continuation: Conversely, strong, news-driven gaps often continue in the direction of the gap, especially if the underlying catalyst is powerful. Traders might enter in the direction of the gap, expecting the momentum to carry through the initial trading hours.

- Arbitrage Opportunities: In some less liquid or less efficient markets, significant price discrepancies can arise between different exchanges or related assets overnight. Astute traders might exploit these temporary inefficiencies through arbitrage.

- Volatility Trading: Night corrections often lead to increased volatility at the market open. Traders specializing in volatility strategies (e.g., using options or volatility ETFs) can profit from these heightened price swings.

- News-Driven Trading: Being among the first to react to significant overnight news can provide an edge. This requires access to real-time news feeds and the ability to quickly assess the market impact of an event.

The Psychological Toll: Navigating Overnight Volatility

The unpredictable nature of night correction tradelt can take a significant psychological toll on traders and investors. The anxiety of holding positions overnight, knowing that a major price swing could occur while you're asleep, is a common source of stress. This emotional burden can lead to poor decision-making, such as prematurely closing profitable trades or holding onto losing positions for too long in the hope of a reversal. The period of time between 'evening' and 'dawn' can be filled with uncertainty for those with open positions. It requires a high degree of discipline to stick to a trading plan, even when faced with the fear of an adverse overnight event. Overcoming this psychological hurdle involves:- Accepting Uncertainty: Acknowledge that overnight events are largely uncontrollable. Focus on what you can control: your risk management, position sizing, and research.

- Developing a Robust Plan: Have clear rules for when to hold positions overnight and when to close them. Define your maximum acceptable overnight loss.

- Emotional Detachment: Learn to separate your emotions from your trading decisions. A night correction tradelt is a market event, not a personal attack.

- Regular Review: After an overnight correction, review what happened, why it happened, and how your strategy performed. Learn from both successes and failures.

- Prioritizing Rest: Paradoxically, getting good rest is crucial. Worrying excessively overnight can lead to burnout and impaired judgment during trading hours. Trust your risk management and allow yourself to disengage.

Future Trends: Adapting to an Ever-Connected Global Market

The landscape of night correction tradelt is continuously evolving, driven by technological advancements and increasing global interconnectedness. The distinction between "day" and "night" in financial markets is blurring further, making the concept of overnight shifts even more critical.The Rise of Automated Trading and AI

The proliferation of high-frequency trading (HFT) and algorithmic trading means that market reactions to news and data are becoming almost instantaneous, even during off-hours. AI-driven systems can analyze vast amounts of information and execute trades far faster than any human, potentially exacerbating or mitigating night corrections with unprecedented speed. This means that the window of opportunity to react to an overnight event manually is shrinking, emphasizing the need for robust pre-planned strategies. Other trends shaping the future of night correction tradelt include:- 24/7 Trading Expansion: More traditional assets are moving towards 24/7 trading models, mirroring cryptocurrencies. This will reduce the prevalence of large opening gaps but increase continuous volatility.

- Decentralized Finance (DeFi): The growth of DeFi platforms means that financial activity is increasingly global and permissionless, operating outside traditional market hours and regulatory oversight, potentially introducing new sources of overnight volatility.

- Enhanced Data Analytics: Advanced analytics and predictive modeling are becoming more sophisticated, allowing traders to better anticipate potential overnight catalysts and their market impact.

- Regulatory Scrutiny: As overnight trading becomes more significant, regulators may introduce new rules to ensure fairness and stability, which could impact how night corrections unfold.

Conclusion

The phenomenon of "night correction tradelt" is an undeniable and increasingly influential aspect of modern global finance. Far from being a quiet period for markets, the "night" hours are often a crucible where significant price adjustments, triggered by global news, economic data, or geopolitical events, silently brew or violently erupt. Understanding that the market's "night" is a continuous, dynamic period, rather than a mere time for rest, is crucial for anyone involved in trading or investing. We've explored how these overnight shifts manifest across various asset classes, from the dramatic opening gaps in stocks to the continuous volatility in forex and crypto. More importantly, we've delved into practical strategies for both managing the inherent risks and leveraging the unique opportunities that night corrections present. From meticulous risk management techniques like position sizing and stop-losses to opportunistic approaches like gap trading and news-driven strategies, preparation is key. The psychological resilience required to navigate overnight volatility cannot be overstated. In a world where financial markets are "like night and day" in their contrasting activity levels, yet always interconnected, mastering the emotional aspects of trading is as vital as any technical skill. As we look to the future, with the rise of AI and 24/7 trading, the importance of anticipating and reacting to night correction tradelt will only grow. We hope this comprehensive guide has illuminated the complexities of night correction tradelt and empowered you with the knowledge to approach overnight market shifts with greater confidence and strategic insight. What are your experiences with overnight market movements? Share your thoughts and strategies in the comments below, or explore our other articles on advanced trading techniques to further enhance your market understanding.

Is "Corrections" on Late Night with Seth Meyers Tonight? Watch Late

How Astigmatism Affects Your Night Vision: Understanding Visual

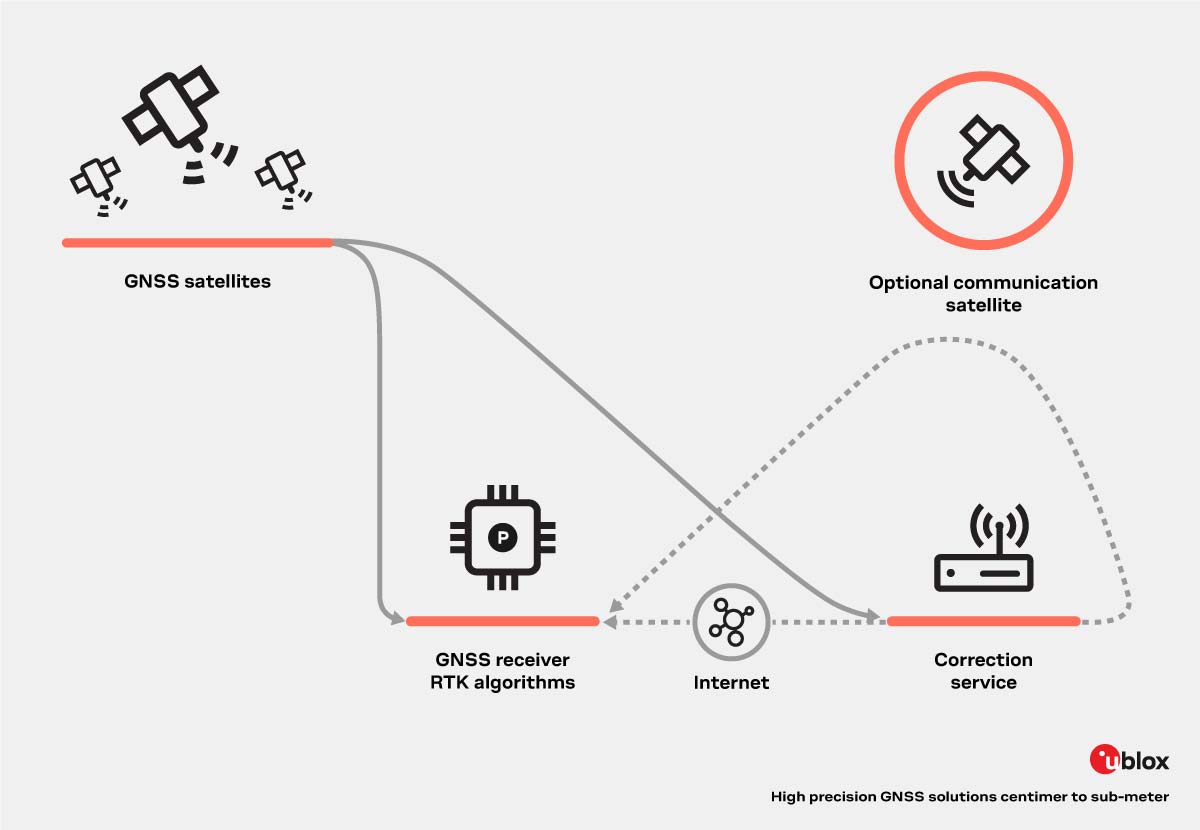

What is NTRIP? | u-blox