Krishna Okhandiar: Unraveling The Saga Of A Crypto Maverick

In the rapidly evolving world of decentralized finance and non-fungible tokens (NFTs), few names have generated as much discussion and controversy as Krishna Okhandiar. Known widely by his pseudonym Charlotte Fang, Okhandiar stands at the nexus of innovation and legal contention within the crypto sphere, having founded prominent entities like the decentralized autonomous organization (DAO) Remilia and the highly popular Milady Maker NFT collection. His journey, marked by significant achievements and equally significant allegations, offers a compelling case study into the complexities and inherent risks of the digital asset landscape.

This article delves deep into the multifaceted persona of Krishna Okhandiar, exploring his rise as a visionary in the NFT space, the creation of his influential projects, and the serious accusations that have recently cast a shadow over his ventures. From claims of being hacked to facing a high-profile lawsuit, Okhandiar's story is a vivid illustration of the volatile nature of crypto entrepreneurship, where digital identity, financial assets, and legal accountability often intertwine in unprecedented ways. Understanding his trajectory provides crucial insights for anyone navigating the high-stakes world of blockchain technology and its burgeoning ecosystems.

Table of Contents

- The Enigmatic Figure: Who is Krishna Okhandiar?

- The Genesis of Remilia and Milady Maker NFT

- The Charlotte Fang Persona: A Digital Identity Unveiled

- Allegations of Hacking: The Crypto Controversy Unfolds

- The Lawsuit: Maxwell Roux and the Remilia Corporation Accusations

- Navigating the Digital Landscape: Krishna Okhandiar's Role as CEO

- Understanding the YMYL and E-E-A-T Principles in Crypto

- The Broader Implications for the NFT and DAO Ecosystem

The Enigmatic Figure: Who is Krishna Okhandiar?

At the heart of several significant developments in the NFT and DAO space lies the figure of Krishna Okhandiar. While his name might not be immediately recognized by everyone outside the crypto community, his pseudonym, Charlotte Fang, has become synonymous with some of the most distinctive and widely discussed projects in the decentralized world. Okhandiar is the founder of Remilia, a decentralized autonomous organization, and the creator of the Milady Maker NFT collection, which has garnered a considerable following and significant market value. His work has positioned him as a key innovator, pushing the boundaries of digital art, community building, and decentralized governance.

Before delving into the controversies, it's important to understand the foundation of his work. Remilia Corporation, under Okhandiar's leadership, has aimed to explore new paradigms for digital identity and community. The Milady Maker NFTs, characterized by their unique aesthetic and cultural commentary, quickly became a sensation, attracting both enthusiasts and investors. This success, however, also brought increased scrutiny and, as is often the case in the high-value, nascent crypto space, attracted challenges and legal disputes. Okhandiar's journey reflects the dual nature of pioneering in a new frontier: immense opportunity coupled with inherent volatility and risk.

Personal Data: A Glimpse into Krishna Okhandiar's Profile

While much of Krishna Okhandiar's public persona is intertwined with his digital alias, Charlotte Fang, some personal and professional details have emerged through various public records and professional networking platforms. These details help to ground the abstract concept of a crypto founder in a more tangible reality.

Below is a summary of available personal data:

| Category | Detail |

|---|---|

| Full Name | Krishna Pandit Okhandiar |

| Known Aliases | Charlotte Fang, and several other online aliases |

| Primary Affiliation | Remilia Corporation (CEO, Founder) |

| Key Projects | Remilia (DAO), Milady Maker NFT |

| Education (Reported) | Illinois Institute of Technology |

| Professional Presence | LinkedIn (View Krishna Pandit Okhandiar’s profile) |

| Current Role | CEO of Remilia Corporation, Producer of popular NFT collectibles |

This information provides a foundational understanding of the individual behind the digital empire, highlighting his educational background and his established presence in professional networks, which lends a degree of credibility to his real-world identity beyond the anonymity often associated with crypto founders.

The Genesis of Remilia and Milady Maker NFT

The story of Krishna Okhandiar is inextricably linked to the creation and evolution of Remilia and the Milady Maker NFT collection. Remilia, conceived as a decentralized autonomous organization, aimed to push the boundaries of digital community and collective ownership. DAOs represent a new form of organizational structure, governed by code and community consensus, rather than traditional hierarchies. Okhandiar, through Remilia, sought to build a framework for artists, developers, and enthusiasts to collaborate and create within the Web3 ecosystem.

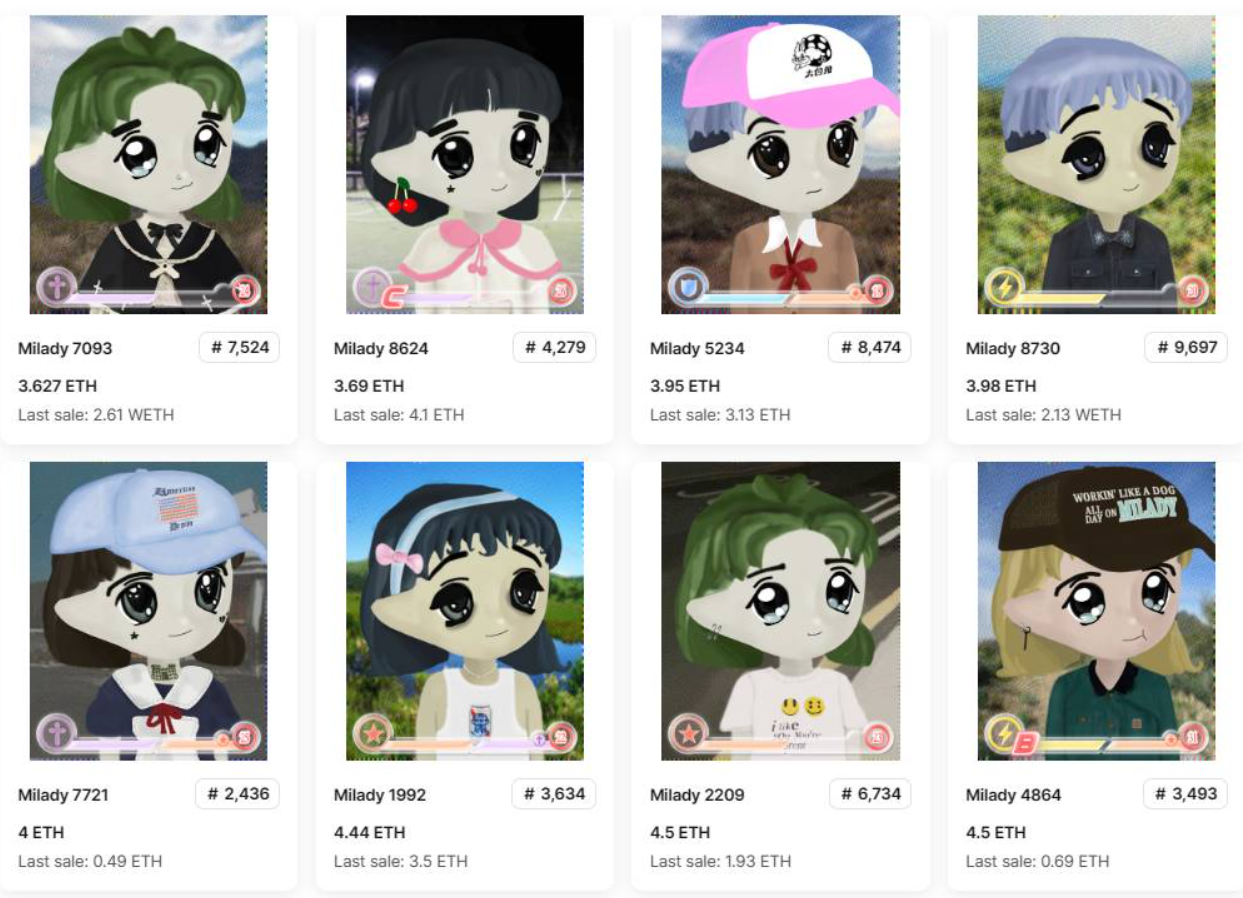

The crown jewel of Remilia's early endeavors was the Milady Maker NFT collection. Launched into a burgeoning NFT market, Milady Maker quickly distinguished itself with its distinctive anime-inspired art style and a community that embraced its unique, often edgy, aesthetic. These NFTs were not just digital collectibles; they became symbols of a subculture, fostering a strong sense of identity among their holders. The success of Milady Maker translated into significant trading volumes and a dedicated fanbase, propelling Krishna Okhandiar and his projects into the spotlight of the NFT world. This period marked a high point, showcasing Okhandiar's ability to innovate and capture the zeitgeist of digital culture, attracting considerable investment and attention to the Remilia ecosystem.

The Charlotte Fang Persona: A Digital Identity Unveiled

One of the most intriguing aspects of Krishna Okhandiar's public presence is his prominent use of the pseudonym Charlotte Fang. In the crypto space, where anonymity or semi-anonymity is common, Charlotte Fang emerged as a distinct and recognizable digital identity, becoming the public face and voice of Remilia and Milady Maker. This persona allowed Okhandiar to cultivate a specific brand image, often characterized by a blend of artistic vision, philosophical musings, and a somewhat enigmatic online presence. The Charlotte Fang persona was instrumental in shaping the narrative around Milady Maker, contributing to its mystique and appeal.

The use of a pseudonym, while offering a degree of personal privacy, also introduces complexities, especially when legal or financial issues arise. For many in the crypto community, Charlotte Fang was the founder, the artist, the visionary. The eventual public association of Charlotte Fang with Krishna Okhandiar revealed the real-world individual behind the digital avatar, a common occurrence as crypto projects mature and face increased scrutiny. This unveiling, while perhaps inevitable, highlighted the tension between the decentralized, often anonymous ideals of Web3 and the traditional legal frameworks that require identifiable entities for accountability.

Allegations of Hacking: The Crypto Controversy Unfolds

The success and high profile of Remilia and Milady Maker eventually brought them under intense scrutiny, leading to serious allegations that have significantly impacted the reputation of Krishna Okhandiar. One of the most critical claims to emerge is that Okhandiar, under his alias Charlotte Fang, reportedly claimed to be hacked after large quantities of Ether (ETH) and NFTs were moved from associated wallets. Such claims are not uncommon in the volatile crypto space, where security breaches and exploits are a constant threat. However, the context surrounding these particular alleged incidents has raised questions and fueled skepticism within the community.

The reported "hack" incidents, involving substantial amounts of digital assets, immediately triggered concerns among investors and community members. In the world of crypto, a hack can mean irreversible loss of funds, and the responsibility often falls squarely on the individual or entity holding the private keys. While a genuine hack would elicit sympathy, the timing and circumstances of these claims, particularly in conjunction with other developing legal issues, have led to a complex narrative where the line between victim and perpetrator becomes blurred. These allegations underscore the critical importance of robust security practices and transparent communication in the management of high-value digital assets, especially when a founder's personal and project funds are intertwined.

The Lawsuit: Maxwell Roux and the Remilia Corporation Accusations

Adding another layer of complexity to the saga of Krishna Okhandiar is the significant lawsuit filed against him. This legal action targets Krishna Okhandiar—also known as Charlotte Fang and by several other online aliases—along with two alleged shell companies he founded. The lawsuit was filed by Maxwell Roux, a name that has become prominent in the context of these legal disputes. Roux, along with three other individuals affiliated with the Remilia Corporation—John Duff, Henry Smith, and Bruno Nispel—have collectively accused Krishna Okhandiar of serious misconduct.

The filing of such a lawsuit in the crypto space is a stark reminder that even in decentralized environments, traditional legal frameworks eventually come into play, especially when substantial financial assets and contractual obligations are involved. The lawsuit represents a direct challenge to Okhandiar's management and handling of funds associated with Remilia, bringing the disputes from the realm of online speculation into the formal legal system. This development is crucial, as it seeks to establish accountability through established legal channels, which can have far-reaching implications for how decentralized projects are managed and how founders are held responsible.

Misappropriation of Funds: The Core of the Allegations

At the very heart of the lawsuit against Krishna Okhandiar are grave accusations of the misappropriation of funds. John Duff, Henry Smith, Maxwell Roux, and Bruno Nispel, all affiliated with the Remilia Corporation, have explicitly accused Okhandiar of this serious offense. Misappropriation, in a legal sense, refers to the unauthorized or improper use of funds or property entrusted to one's care. In the context of a DAO and NFT project, this could involve using community funds, project treasuries, or investor capital for personal gain or unauthorized purposes, rather than for the stated goals of the project.

These allegations strike at the core of trust within decentralized communities. DAOs are designed to be transparent and governed by their members, with funds often held in multi-signature wallets or smart contracts requiring community consensus for expenditures. Accusations of misappropriation undermine the very principles of decentralization and trustless systems that blockchain technology aims to foster. The lawsuit will likely seek to uncover the flow of funds, the decisions made regarding the assets, and whether these actions align with the agreed-upon governance and operational principles of Remilia. The outcome of this legal battle will not only determine the fate of Krishna Okhandiar but also set precedents for accountability in the burgeoning world of decentralized finance and digital assets.

Navigating the Digital Landscape: Krishna Okhandiar's Role as CEO

Despite the swirling controversies and legal challenges, Krishna Okhandiar currently serves as the CEO of Remilia Corporation and remains the producer of popular NFT collectibles, most notably the Milady Maker series. This continued leadership role, even amidst serious allegations, highlights the unique and often complex dynamics within the crypto industry. In traditional corporate structures, such accusations would typically lead to immediate suspension or resignation. However, in the decentralized space, where lines of authority can be blurred and community sentiment plays a significant role, the path forward is often less clear-cut.

As CEO, Okhandiar's responsibilities would include strategic direction, community management, and the overall health of the Remilia ecosystem. His continued involvement means he is still at the helm of a project that holds significant value and has a dedicated community. This situation presents a challenging scenario for both the project and its stakeholders. It underscores the need for clear governance structures, robust accountability mechanisms, and perhaps, more traditional corporate oversight as decentralized projects grow in scale and value. The ongoing legal proceedings will undoubtedly influence his capacity to lead and the future trajectory of Remilia and its associated projects under his continued stewardship.

Understanding the YMYL and E-E-A-T Principles in Crypto

The story of Krishna Okhandiar and the controversies surrounding Remilia and Milady Maker serves as a potent case study for understanding the critical importance of YMYL (Your Money or Your Life) and E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness) principles, especially within the context of the crypto and NFT space. YMYL topics are those that could potentially impact a person's future happiness, health, financial stability, or safety. Given that cryptocurrencies and NFTs involve significant financial investments and carry inherent risks, they fall squarely into the YMYL category. This means that information presented about them must adhere to the highest standards of accuracy and reliability.

E-E-A-T principles, championed by search engines like Google, are guidelines for assessing the quality of content, particularly for YMYL topics. When discussing individuals like Krishna Okhandiar who manage projects involving substantial financial assets, it becomes imperative to evaluate the content based on: * **Expertise:** Does the information demonstrate a deep understanding of crypto, DAOs, and NFTs? * **Experience:** Does the content reflect real-world engagement with the subject matter, or is it merely theoretical? * **Authoritativeness:** Is the information sourced from credible entities or individuals, and is it presented in an unbiased manner? * **Trustworthiness:** Is the information accurate, verifiable, and free from misleading claims? This framework is crucial for readers to discern reliable information from speculation or misinformation, especially when their financial well-being is at stake.

The Importance of Trust in Decentralized Spaces

The very foundation of decentralized finance and blockchain technology is built on the concept of "trustlessness," meaning systems are designed to operate without the need for intermediaries or central authorities. However, this "trustlessness" applies to the technology itself, not necessarily to the individuals or teams building on it. As the case of Krishna Okhandiar illustrates, trust in the people behind the projects remains paramount. When founders are accused of misappropriation or hacks, it erodes the community's confidence not only in that specific project but potentially in the broader decentralized ecosystem.

For investors and participants, assessing the trustworthiness of project founders and core teams becomes a critical, albeit challenging, task. Transparency in operations, clear communication, and a track record of ethical conduct are vital for building and maintaining this trust. The allegations against Okhandiar highlight the vulnerability of even seemingly robust decentralized structures to the actions of centralized figures at their helm. The long-term success and adoption of Web3 depend heavily on the ability of projects to foster genuine trust, not just in their code, but in their human leadership.

Due Diligence: Protecting Your Digital Assets

The ongoing legal and financial controversies surrounding Krishna Okhandiar and his projects serve as a stark reminder of the absolute necessity of rigorous due diligence in the crypto and NFT space. Unlike traditional markets with established regulatory bodies and consumer protections, the decentralized world often operates with fewer safeguards. This places a greater onus on individual participants to thoroughly research and understand the risks involved before committing their capital.

For anyone considering investing in NFTs, participating in DAOs, or engaging with new crypto projects, due diligence should include:

- **Researching the Team:** Who are the founders? Do they use pseudonyms, and if so, is their real identity known and reputable? What is their track record?

- **Understanding the Project's Governance:** How are decisions made? Is there a clear process for fund management? Are multi-sig wallets used, and who holds the keys?

- **Auditing Smart Contracts:** Has the project's code been audited by reputable third parties?

- **Community Sentiment and Activity:** Is the community engaged and healthy? Are there ongoing discussions about potential red flags?

- **Legal Structure (if any):** Are there any legal entities involved, and what are their jurisdictions?

- **Risk Assessment:** What are the potential downsides? How would a hack or a founder's misconduct impact your investment?

The Broader Implications for the NFT and DAO Ecosystem

The narrative surrounding Krishna Okhandiar extends beyond the individual and his projects, offering significant insights into the broader challenges and evolving landscape of the NFT and DAO ecosystem. His story highlights several critical areas that the decentralized world must address as it matures:

- **Accountability in Decentralized Structures:** While DAOs aim for decentralization, many still rely heavily on core teams or founders for initial development and ongoing direction. The allegations against Okhandiar force a re-evaluation of how accountability is established and enforced when a centralized figure holds significant sway over ostensibly decentralized assets.

- **The Role of Pseudonymity:** The case of Charlotte Fang becoming publicly known as Krishna Okhandiar demonstrates the inherent tension between the desire for privacy in Web3 and the demands for transparency and legal accountability in the real world. This will likely lead to more nuanced discussions about when and how founders' identities should be disclosed.

- **Investor Protection in Nascent Markets:** The lack of robust regulatory frameworks in crypto means that investors are often exposed to greater risks. High-profile cases like this will inevitably prompt calls for clearer guidelines and potentially new forms of investor protection, even as the industry strives for decentralization.

- **Community Governance Challenges:** Even with a DAO structure, community members may struggle to exert control or hold leaders accountable, especially when large sums of money are involved or when legal complexities arise. This emphasizes the need for stronger, more active, and well-defined governance mechanisms within DAOs.

- **Security Best Practices:** The claims of being hacked, regardless of their veracity, underscore the constant threat of security breaches in the crypto space. This reinforces the importance of multi-layered security protocols, independent audits, and continuous vigilance for all projects and individuals holding digital assets.

Ultimately, the saga of Krishna Okhandiar is a microcosm of the challenges facing the entire Web3 movement. It underscores the immense potential for innovation and community building, but also the critical need for ethical leadership, robust security, and clear pathways for accountability as digital assets become an increasingly significant part of the global economy. The lessons learned from this case will undoubtedly shape the future development and regulation of decentralized technologies.

Conclusion

The journey of Krishna Okhandiar, from visionary founder of Remilia and Milady Maker to the center of hacking claims and a significant lawsuit, encapsulates the exhilarating highs and perilous lows of the crypto and NFT world. Known as Charlotte Fang, Okhandiar successfully built a prominent digital empire, attracting a dedicated community and substantial investment. However, the subsequent allegations of misappropriation of funds and reported hacks have cast a long shadow, highlighting the critical need for transparency, accountability, and robust security in decentralized finance.

This unfolding narrative serves as a vital lesson for anyone involved in or considering entering the digital asset space. It underscores that while blockchain technology offers revolutionary potential for decentralization and trustless systems, the human element—the founders, developers, and community leaders—remains a crucial factor in a project's integrity and success. The principles of E-E-A-T and the YMYL considerations are not merely academic concepts but practical necessities for navigating this high-stakes environment.

We invite you to share your thoughts on the implications of this case for the future of DAOs and NFTs in the comments below. Have you encountered similar situations, or do you have insights into how trust and accountability can be better established in decentralized communities? Your experiences and perspectives contribute to a richer understanding of this evolving landscape. For more in-depth analyses of crypto security and decentralized governance, explore other articles on our site.

Nhà sáng lập NFT Milady bị rút cạn hàng triệu USD | Cập nhật tin tức

Founder of Remilia Reports Suspected Hack After Movement of Ether, NFTs

Lord Krishna Wallpapers Hd For Mobile Hindu god krishna wallpapers | Hd